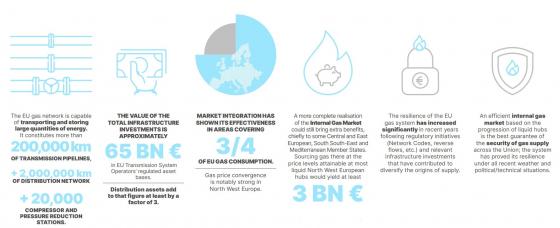

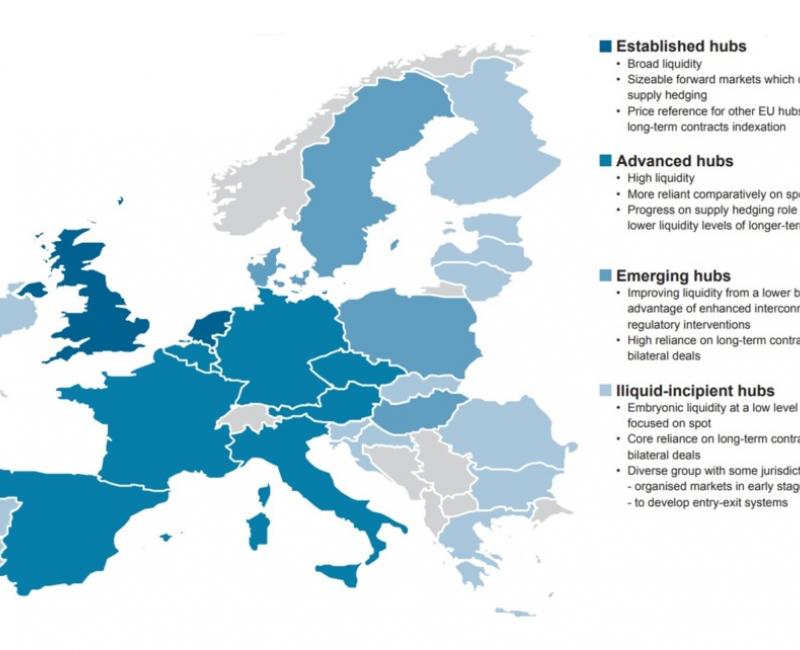

Despite the unprecedented impact of COVID-19 over the economy of the EU, the functioning of the EU gas market continued to improve in 2020. This has been evidenced by an increase in markets’ price integration and supply competition, as well as by the rise in liquidity at many gas trading hubs. Markets representing three quarters of EU gas consumption are assessed today as well functioning and sufficiently integrated. Other jurisdictions with some of the historically less developed hubs are also showing promising signs of progress.

This is one of the main conclusions of the first volume released (Gas Wholesale Volume) of the annual Market Monitoring Report (MMR) developed by the EU Agency for the Cooperation of Energy Regulators (ACER), the Council of European Energy Regulators (CEER) and the Energy Community.

With the volume on Gas Wholesale being the first to be published this year; the other two volumes, namely, Electricity Wholesale and Retail and Consumer Protection, will be released later this year.

The Gas Wholesale Volume published today presents the results of monitoring the gas markets of the European Union and the Energy Community (a selection of neighbouring countries in Southeast Europe and the Black Sea region committed to extending the EU internal energy market). The volume assesses the progress made towards a fully functioning internal gas market. Complementarily it offers recommendations to overcome some identified barriers that can still hinder the competitiveness of selected markets or limit their market integration.

Access the Gas Wholesale Volume.

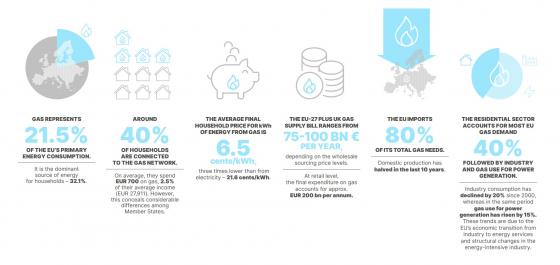

Coinciding with the launching of this volume, ACER presents a series of key facts of the EU gas sector.

COVID-19 together with LNG rising imports depressed prices, bolstered hub liquidity and reduced cross-border flows

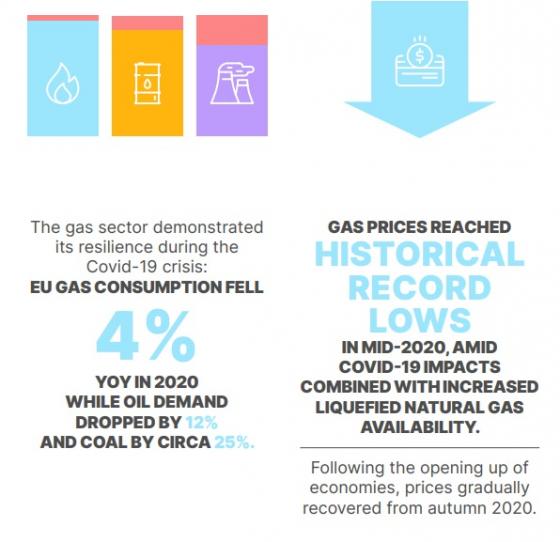

The significant impact of COVID-19 on gas demand, together with the irregular import volumes of liquefied natural gas (LNG) led to a series of supply and demand rebalances throughout the year. This setting impacted on prices, market liquidity, cross-border flows and other key metrics, some of which moved to levels not seen before.

The COVID-19 related reduction in economic activity led to a substantial decrease of gas demand in the second quarter of 2020. That coincided with record deliveries of LNG and record-high gas stocks in underground storages in the first half of the year. All these factors, together with the reduced prices of other energy commodities, resulted in historically low EU gas hub prices in spring and early summer of 2020. However, gas demand recovered after summer, while LNG deliveries decreased substantially from the third quarter onwards because many cargoes shifted away into Asian markets. Hub prices recovered accordingly and by the end of the year, they had climbed beyond 2019 levels.

Hub traded volumes also reached historical highs increasing by 14% as market participants continuously re-adjusted their positions due to the changing supply balance and the high price volatility.

Common EU rules are bearing fruit; neighbouring countries are starting to apply them

In light of record-high price volatility, the price convergence between EU gas hubs increased compared to 2019. Amongst other reasons, abundant supply and availability of interconnection capacity smoothed regional price differences. Though full price convergence is not the aim of the Internal EU Gas Market, greater price convergence indicates that market integration is improving.

Network codes, the common EU rules intended to facilitate the harmonisation, integration and efficiency of the European gas market, are producing results. For instance, cross-border gas flows are progressively becoming more responsive to hub price signals assisted by the higher flexibility that the codes grant to transport capacity bookings. Also due to EU regulation, the balancing of gas systems has become more transparent and market based. That has also helped to improve the liquidity in some spot markets.

As of 2020, all gas network codes are also applicable in the Energy Community Contracting Parties. However, their implementation advanced only in Ukraine, generating the first beneficial effects on market integration with EU neighbouring countries. Due to some positive regulatory changes, also gas trading activity substantially increased in Ukraine.

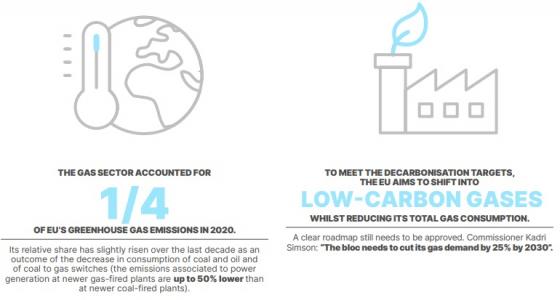

Does gas contribute to decarbonisation?

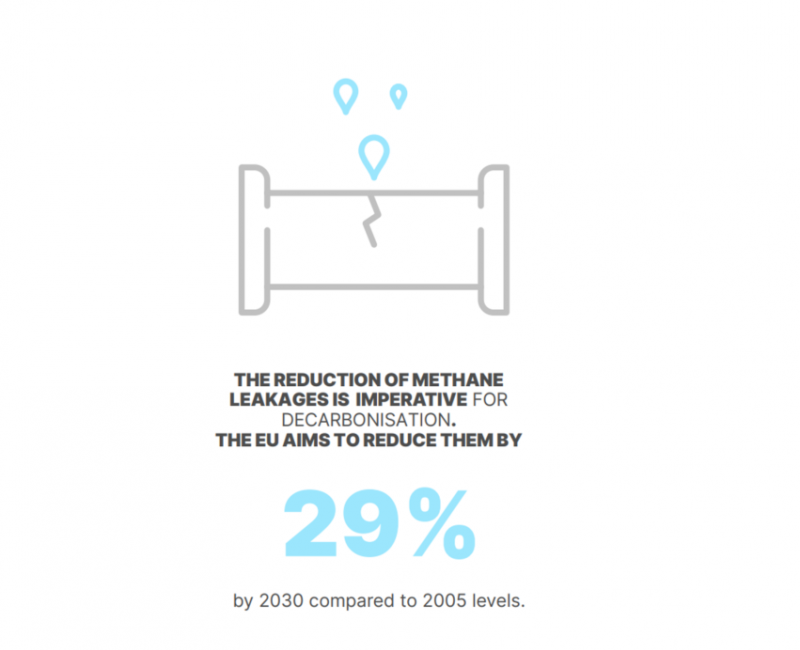

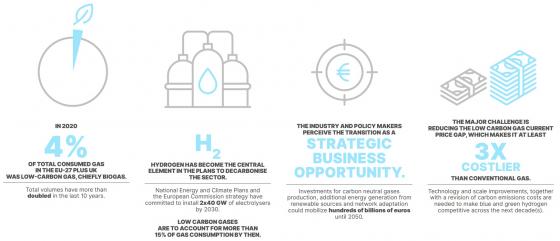

In recent years, gas has contributed to the EU energy sector decarbonisation by replacing higher carbon emitting fuels like coal and in some instances oil in power generation. However, gas is also a significant source of greenhouse gas emissions in its own right. Therefore, conventional natural gas needs to be fully replaced by alternative energy sources or by low-carbon and renewable gases in 2050. To enable such a shift the European Commission will shortly launch a review of the gas legislative framework as part of its Fit for 55 package.

The supply share of low-carbon gas is still low in the EU even if it has doubled in the last 10 years. Low-carbon gases accounted for only 3.8% of total gas supply in 2020, chiefly in the form of biogas. This is because the cost of the currently cheapest low-carbon gas, biogas, was three to four times higher than the price of conventional natural gas at average 2020 prices. Green hydrogen produced at water electrolyser facilities with renewable power is becoming central in the EU hydrogen strategy. However, at present, it remains limited compared to future expectations, while less than 3% of commercial hydrogen supply was produced using electrolysis in 2020. A combination of market, technological and policy drivers will determine the reach of each low-carbon gas technology or alternatives in the years to come.