ACER calls for improvements in ENTSOs’ 2024 draft TYNDP scenarios to comply with its Framework Guidelines

ACER calls for improvements in ENTSOs’ 2024 draft TYNDP scenarios to comply with its Framework Guidelines

What is it about?

ACER publishes today its Opinion on the compliance of the draft joint Scenarios Report for the Ten-Year Network Development Plan (TYNDP) 2024 with ACER’s Framework Guidelines.

The draft joint Scenarios Report for the TYNDP is issued by the European Network of Transmission System Operators for Gas (ENTSOG) and electricity (ENTSO-E) every two years. ACER reviews the draft Scenarios Report to ensure compliance with its Framework Guidelines, as this contributes to build a solid foundation to the European energy network development.

What are the network development scenarios?

Network development scenarios are key for planning future energy infrastructure. They project the evolution of the European energy system over the coming decade and guide the development of infrastructure needed to achieve Europe’s decarbonisation goals.

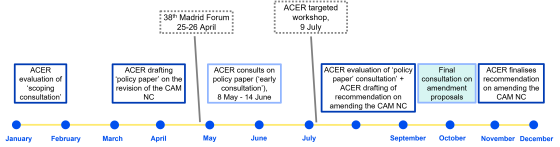

Under the TEN-E Regulation, ACER is responsible for creating Framework Guidelines for Scenario Development, while ENTSOG and ENTSO-E (the ‘ENTSOs’) are tasked with developing network scenarios based on these guidelines. In January 2023, ACER published its Framework Guidelines, aiming to establish a transparent, inclusive, and robust process.

What are ACER’s key findings?

While welcoming some improvements in the scenarios’ development process, ACER’s assessment identifies several areas of non-compliance with its Framework Guidelines:

- Diverging scenarios: rather than developing different scenario variants based on economic factors, the ENTSOs created diverging scenarios, leading to less reliable results.

- Delayed process: scenarios’ development was delayed, negatively impacting other processes, such as the infrastructure gaps assessment or the project-specific cost-benefit analysis.

- Slower stakeholder group formation: the process of establishing the Stakeholder Reference Group took longer than expected, which impacted the stakeholder engagement’s overall effectiveness.

- Transparency: despite enhanced transparency and stakeholder consultations, the draft 2024 Scenarios Report still did not fully meet the transparency standards set by the Framework Guidelines. For instance, a detailed reasoning on how the stakeholders’ observations were addressed or considered has not been provided.

What are the next steps?

ACER expects some of these issues to be addressed in the final 2024 Scenarios Report for the TYNDP and anticipates that ENTSOG and ENTSO-E will further tackle the remaining shortcomings in the 2026 scenarios.

In line with the TEN-E Regulation, the European Commission will review the draft joint Scenarios Report for TYNDP and, taking into account ACER’s Opinion, it will either approve it or ask the ENTSOs for amendments.