ACER assesses the consistency of national and European gas and hydrogen network plans

ACER assesses the consistency of national and European gas and hydrogen network plans

What is it about?

The EU Agency for the Cooperation of Energy Regulators (ACER) publishes an Opinion assessing the consistency of the most recently published national gas and hydrogen network development plans (NDPs) with the EU-wide Ten-Year Network Development Plan (EU TYNDP).

The comprehensive review is carried out biannually and is based on the information provided by national regulatory authorities (NRAs).

ACER analyses the regulatory aspects and key features of the gas NDPs, as well as the inputs, the methodology used and the resulting outputs, focusing on changes observed during the last two years.

The review also analyses whether the gas NDPs cover energy transition aspects, such as the hydrogen and biomethane developments, the blending of hydrogen and biomethane in gas transmission networks, the existence of hydrogen blending targets, hydrogen strategies and plans for dedicated hydrogen networks.

Project-consistency of national and European gas network plans

ACER is concerned by a continuous falling level of project consistency between gas NDPs and the draft EU TYNDP 2022, compared to previous editions of the EU TYNDP. This is largely explained by the inclusion of hydrogen and biomethane projects in the draft EU TYNDP 2022 which, however, are often not part of the most recent gas NDPs.

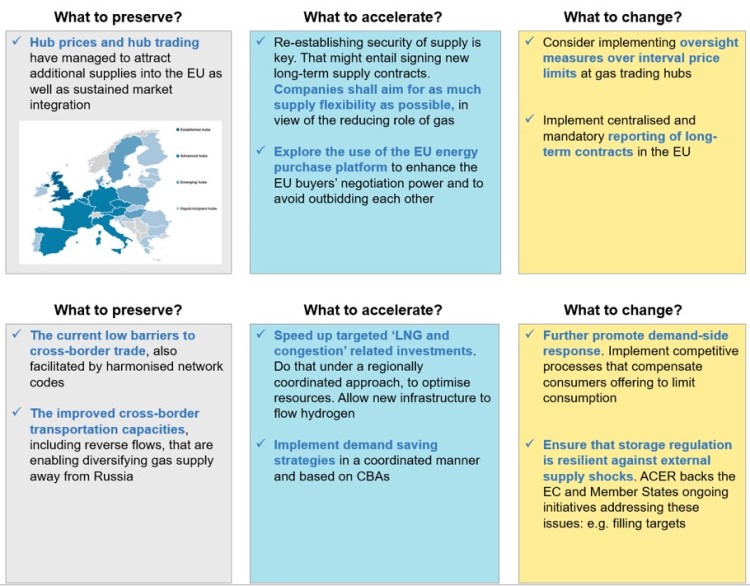

ACER Recommendations

ACERs recommendations aim to improve the consistency of national and European plans and to align network plans with decarbonisation efforts.

NDPs should:

- Focus on investments allowing low-carbon and renewable gases to be injected into the networks;

- Consider possible future needs to decommission gas infrastructure;

- Be better coordinated with neighbouring Member States for cross-border issues;

- Include project cost data;

- Include soon-to-be-operational infrastructure aimed to phase out Russian gas;

- Build on compatible scenarios aligned with targets of decarbonisation and phase out dependency on Russian gas.

The EU TYNDP should:

- Reconcile the large number of investment projects with the projected downward gas demand;

- Make gas decarbonisation a main driver of network development;

- Include project costs and monetised benefits data (as it is already the case in the electricity TYNDP);

- Be primarily based on NDPs;

- Include suitable areas for location of power-to-gas assets, in coordination with electricity TYNDP assessments;

- Synchronise expectations of uptick of supply and demand of renewable hydrogen and biomethane with a prudent assessment of need of transportation services.

Key findings on aligning national and EU network plans with decarbonisation targets:

- NRAs would support an EU-wide approach to hydrogen blending limits;

- Hydrogen blending is likely to be a temporary or transitional solution towards decarbonisation;

- Essential network adaptations are required to allow for hydrogen injection in the transmission network;

- The number of Member States with hydrogen strategies doubled in the last two years. However, limited progress is observed regarding the readiness of gas transmission networks and national legislations for accommodating hydrogen.

Access the ACER Opinion and its Annexes I and II and Annex III, which provide comprehensive information on the most recent gas and hydrogen plans. Slides summarise selective findings of this ACER assessment of the gas TYNDP.