Electricity system operators’ bidding zone study significantly underestimates the benefits of reshaping Europe’s bidding zones

Electricity system operators’ bidding zone study significantly underestimates the benefits of reshaping Europe’s bidding zones

What is it about?

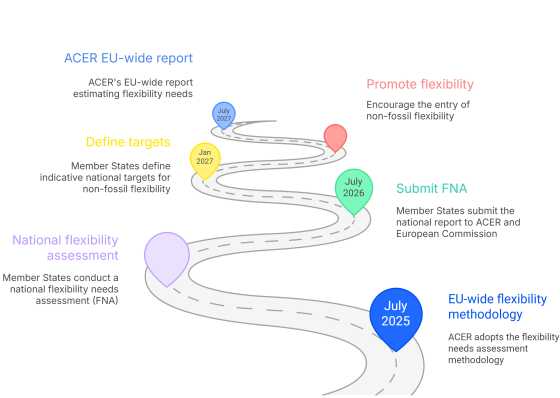

ACER releases today an Opinion assessing whether the European transmission system operators (TSOs) followed the EU legal and regulatory framework when performing their bidding zone review study published on 28 April 2025.

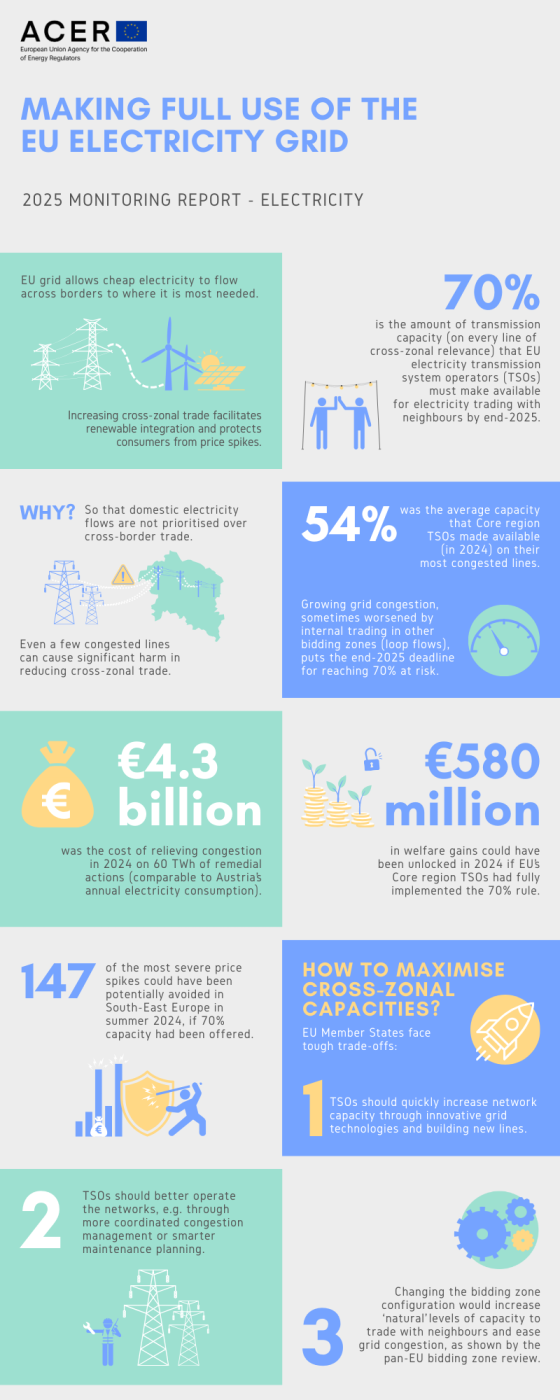

Currently, most bidding zones in the EU are defined by national borders. But, under EU law, bidding zones must be formed in a way that maximises economic efficiency and cross-zonal trading opportunities, while ensuring security of supply. To achieve this, a review of the existing bidding zones was needed to identify structural grid congestions and evaluate the potential benefits of alternative configurations.

In the review process, ACER role was to set the methodology and identify alternative bidding zone configurations for TSOs to consider in their review.

The TSOs’ report, which assesses 14 bidding zones configurations across Central and Northern Europe, is intended to help EU Member States decide whether to amend or keep the current bidding zones.

This ACER’s Opinion, addressed to the Council of the EU, assesses whether the TSOs’ study followed the agreed bidding zone review methodology and evaluates the impact of any deviations. It is not intended as a recommendation for Member States’ decisions.

What are the key findings?

ACER finds the study broadly aligns with the EU framework but significantly underestimates the benefits of re-shaping Europe’s electricity bidding zones. ACER identifies two main shortcomings:

- Central European TSOs’ coordination level in solving network congestions has been overestimated. Hence, the TSOs’ study undervalues the efficiency gains of alternative reconfigurations that split the bidding zone of Germany-Luxembourg and that link them up with a bidding zone reconfiguration in the Netherlands. ACER estimates the benefits of those configurations in the order of 450-540 million EUR per year, 70% higher than TSOs’ assessment.

- TSOs’ estimated costs for reconfiguring the bidding zones are based on limited stakeholders’ input and do not sufficiently reflect past experiences.

ACER acknowledges the significant work by TSOs and other stakeholders in the study and the overall positive collaboration. The ACER Opinion also draws some recommendations to ensure a more effective and efficient process going forward.

What are the next steps?

Following the publication of the TSOs’ report (28 April 2025) Member States have six months to decide whether to amend the current bidding zones. If individual Member States wish to amend their bidding zone configuration, but no unanimous agreement is reached among the relevant parties, the European Commission (after consulting ACER) will have six months to decide.