ACER approves the European Network of Transmission System Operators for Electricity’s (ENTSO-E’s) European Resource Adequacy Assessment for 2023 (ERAA 2023). However, ACER also calls for further enhancements in the next annual assessment (ERAA 2024).

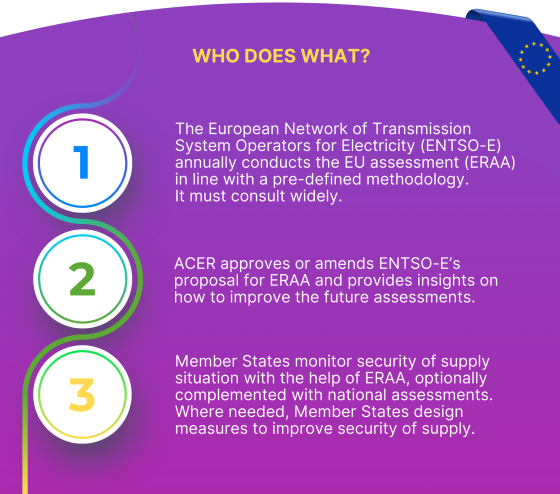

ENTSO-E is required to assess, annually, the risks to EU security of supply in its ERAA. This assessment aims to provide an up-to-date outlook for 10 years ahead, helping policy makers to make timely security of supply decisions. The next edition, ERAA 2024, is due in November 2024.

What does ACER expect in the ERAA?

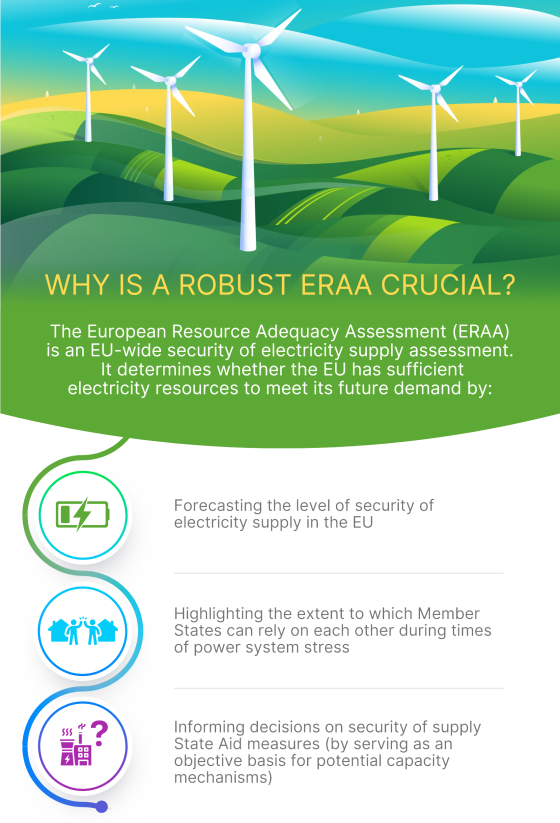

ACER considers that a robust ERAA must:

- Forecast the level of EU security of electricity supply and identify concerns about potential scarcity of supply, basing this analysis on consistent assumptions and modelling approaches.

- Provide visibility on the electricity interdependencies of EU Member States by showing clearly how changes in one country’s demand and/or supply affect the electricity security of supply of another country.

- Show how Member States can rely on each other during times of power system stress.

- Provide an objective basis for assessing additional national measures (including State Aid) to improve the European security of electricity supply.

What does ACER say about ERAA 2023 and what improvements are needed for 2024?

ACER approves the European Resource Adequacy Assessment, marking a milestone for the security of electricity supply across the EU and acknowledging interdependencies among Member States. It is the first time in three years of ENTSO-E’s assessment that ACER has approved it (see ACER’s communications on ERAA 2022 and on ERAA 2021).

Considering that ERAA 2023 is the last assessment to be undertaken within the 3-year implementation period for complying with the ERAA methodology and the improvements made by ENTSO-E, ACER finds that ERAA 2023 is sufficient. In particular, ACER acknowledges the improvements made in:

- Increasing consistency of the assumptions used when modelling adequacy risks and investment behaviours.

- Analysing how the European network infrastructure evolved and expanded over time.

- Aligning more closely with the EU greenhouse gas emissions target for 2030.

However, for ERAA to fully comply with the methodology and be a reliable tool for policymakers, ACER considers that ENTSO-E must strengthen ERAA 2024 as follows:

- Adopt more robust modelling approaches.

- Estimate cross-zonal capacities by applying the flow-based capacity calculation method (as per current rules), rather than using Net Transfer Capacities (NTCs).

- Ensure greater consistency with market rules and improve the modelling of investment behaviour.

Failing to implement these improvements may compromise the robustness of the assessment. For example, without changing the modelling approaches, ERAA will be prone to inconsistencies between market entry and exit decisions and the estimated adequacy risks. Ultimately, the absence of improvements to ERAA would impede the adoption of robust security of supply decisions by Member States.

What are the next steps?

As ENTSO-E’s proposal for 2024 is expected by November 2024, ACER continues its engagement with ENTSO-E and others (e.g. Member States, the European Commission, the Joint Research Centre) so that the ERAA continues to improve.

- First, ACER's reply to ENTSO-E's public consultation (on preliminary input data), calls for ENTSO-E to increase the level of transparency concerning three main sets of assumptions: cross-zonal trading capacities, demand response and demand projections.

- Second, to facilitate timely implementation of ACER’s recommendations (which are included in the ACER Decision published today), ACER communicated these priority areas (and suggestions on how to address them) in a letter addressed to ENTSO-E already in March 2024. As stated above, the three priority areas that need to be strengthened concern robust modelling approaches, consistency of cross-zonal capacities and strengthening the consistency of market rules and investment behaviour.

ACER considers having a solid ERAA in place in 2024 important because:

- ERAA is relevant to the European Commission’s upcoming (2024) proposals to streamline the procedures concerning the application of capacity mechanisms.

- It links to the upcoming (2025) ACER methodology for the flexibility needs assessment performed by all Member States (which will complement the ERAA).

Would you like to dive into the topic?

Access ACER Decision 06/2024 and its annexes.

Access the consolidated version of the approved ERAA 2023 as provided by ENTSO-E: executive report and annexes.

ACER’s new dynamic dashboard allows stakeholders to explore the data categories used in ERAA’s different editions, including those proposed for ERAA 2024.