Bogdan Chirițoiu is the new Chair of the ACER Administrative Board

Bogdan Chirițoiu is the new Chair of the ACER Administrative Board

What is it about?

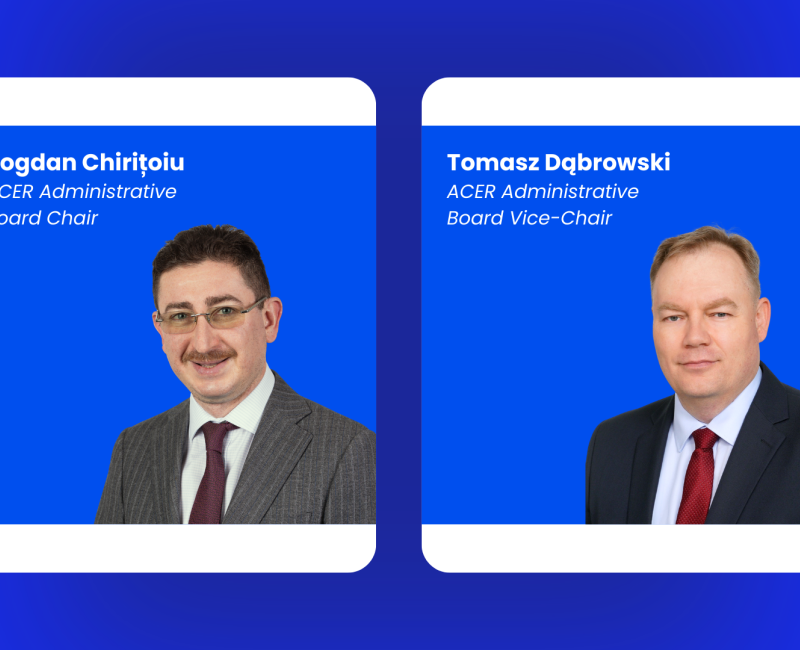

Mr Bogdan Chirițoiu takes over as the new Chair of the Administrative Board of the EU Agency for the Cooperation of Energy Regulators (ACER), and Mr Tomasz Dąbrowski as the Vice-Chair.

They were elected by consensus by the Administrative Board on 11 December 2025. The term of office of the ACER Administrative Board Chair and Vice-Chair is two years, renewable once, effective from 22 January 2026.

Mr Volker Zuleger, ACER Director ad interim, welcomed Mr Chirițoiu and Mr Dąbrowski to their new roles. He pointed to their understanding of oversight and governance issues of an EU agency, gained from serving as members of the ACER Administrative Board (and in Mr Chirițoiu’s case as Vice-Chair). Such first-hand experiences of ACER will be invaluable to the Administrative Board at a time of significant change in ACER’s leadership. An immediate task is the recruitment of the new ACER Director (in 2026) to head up and run the EU Agency.

Mr Zuleger expressed his deep appreciation to the outgoing Administrative Board Chair, Ms Edit Herczog, for her commitment as Chair for the past 2 years and previously as the Vice-Chair.

Mr Chirițoiu is Chairman of the Romanian Competition Council, the National Competition Authority since 2009. He holds a PhD in Economics. His professional career includes posts as State Councillor and as a university lecturer.

Mr Dąbrowski is Head of Legal Services at Zarządca Rozliczeń S.A., the state agency in charge of disbursement of payments under the state aid schemes for the power sector in Poland. He has deep knowledge of the energy sector including having served in Poland’s Ministry of Energy.

Changes in the Administrative Board Members and Alternates

In addition to Ms Herczog, the longstanding Board member Mr Jurij Spiridonovs and alternate member Ms Britta Thomsen are leaving the Board, while the mandate of alternate member Mr Attila Nyikos is also coming to an end. The European Parliament has appointed Ms Josianne Cutajar as a new member and Mr Markus Pieper as an alternate; their mandate started on 22 January 2026.

The Council of the EU appointed two members and three alternates. It reappointed Mr Václav Bartuška as a member for a second four-year term, as well as Mr Atanas Georgiev and Mr Boris Makšijan as alternate members for a second term. The Council also appointed Mr Jorge Sousa as a member and Mr Oliver Púček as an alternate member for the first time. Their mandates start on 28 January 2026.

ACER welcomes the Administrative Board Chair and Vice-Chair and new members/alternates while paying tribute to the outgoing ones.

More on ACER’s Administrative Board

The Administrative Board is ACER’s governing body. It appoints its main bodies, including the Director, adopts the annual work programme and its multi-annual programme. It also plays a central role in establishing the Agency’s budget.

The Administrative Board is composed of 9 members and 9 alternates, appointed by the European institutions. 2 members are appointed by the European Commission, 2 by the European Parliament and 5 by the Council of the European Union (and the same composition for the alternates).

Read more about ACER’s Administrative Board Members and Alternates.

For more on ACER governance and the roles of the different bodies, see the Agency's organisation and bodies.

Engagement with energy market associations

Engagement with energy market associations

Scope of ACER's stakeholder activities

ACER regularly engages with European associations of energy market participants on REMIT implementation. These associations play an important role in bringing practical experience and representing a broad range of perspectives from across the energy sector.

Associations participating in ACER’s stakeholder activities are involved in:

- Providing input on the revision of the REMIT data reporting framework, including updates to the reporting guidance.

- Discussing practical aspects of REMIT implementation and related challenges, including data collection and reporting, transaction reporting guidance, data quality and compliance issues.

For 2026-2028, ACER has established two lists of associations:

- EU-level associations representing energy market participants from several Member States, reflecting diverse market segments and expertise, which will take part in regular stakeholder activities.

- A consultative list of associations representing international, national, regional or local interests, which may be engaged on an ad hoc basis depending on topics and expertise required. This list will not be made public.

For this period, the list of EU-level associations is composed by the following members (in alphabetical order):

- Commodity Council Markets - Europe (CMCE)

- Energy Traders Europe

- Eurelectric

- Eurogas

- Euroheat & Power

- European Association for the Promotion of Cogeneration (COGEN Europe)

- European Network of Network Operators for Hydrogen (ENNOH)

- European Network of Transmission System Operators for Electricity (ENTSO-E)

- European Network of Transmission System Operators for Gas (ENSTOG)

- Gas Infrastructure Europe (GIE)

- Hydrogen Europe

- International Association of Oil and Gas Producers (IOGP Europe)

- Smart Energy Europe (smartEn)

Engagement with energy market associations

Documentation

2025

2025

2026

2026

ACER introduces a framework for monitoring smart grid performance in electricity transmission

ACER introduces a framework for monitoring smart grid performance in electricity transmission

What is it about?

Today, ACER publishes a position paper introducing output performance indicators to measure the performance of grid-enhancing technologies in electricity transmission.

Europe’s energy transition is driving rapid growth in electricity demand and renewable generation, putting increasing pressure on transmission networks. While grid expansion remains key, making better use of existing infrastructure through innovative operational practices, digitalisation and grid-enhancing technologies is equally important, as smart solutions of transmission system operators (TSOs) can often deliver additional capacity faster and at a lower cost.

Why are transmission output performance indicators needed?

EU legislation already requires national regulators to monitor the development of smart electricity grids. To ensure smart grid solutions deliver benefits, regulators need ways to assess their real-world performance.

The June 2025 Copenhagen Infrastructure Forum invited ACER, together with the European Network of Transmission System Operators for Electricity (ENTSO-E) and other stakeholders, to develop a common approach for assessing the performance of smart-grid solutions at transmission level.

In parallel, the Council of European Energy Regulators (CEER) publishes today its report on indicators to measure performance at distribution level.

Assessing transmission smart grid performance

Transmission smart grid infrastructure can be assessed using two types of indicators:

- input, which describe what has been implemented; and

- output, which monitor what has been achieved.

ACER found that few EU countries currently systematically measure how grid-enhancing technologies perform in practice, making it difficult to assess their effectiveness. This ACER paper addresses this gap. It builds a foundation for more consistent and comparable assessments of TSO performance across Europe.

What does ACER recommend?

ACER proposes three output indicators for regulators to assess whether grid-enhancing technologies in transmission grids deliver improvements and cost benefits:

- performance of existing transmission assets in real-time system operations,

- performance of operational security; and

- grid expansion performance.

These performance indicators address grid capacity gains, operational-security cost reductions and cost-efficient alternatives to conventional grid expansion. By capturing their actual performance, these output indicators help ensure that innovative approaches truly unlock grid capacity and reduce system costs.

Beyond the three proposed output indicators, the paper also highlights complementary areas of monitoring that can enhance regulatory insight.

- ACER recommendation for national regulators: Incorporate the proposed indicators as a common framework for monitoring smart-grid performance at transmission level, allowing a two- to three-year transition period for data collection, process setup and methodological refinement.

- ACER recommendation for transmission system operators: Develop complementary input indicators reflecting the availability of tools that influence the proposed output indicators, with ENTSO-E providing guidance and reference mappings to ensure consistency across the EU.

What are the next steps?

Implementation should follow a phased, learning-oriented approach, starting with national testing of the indicators. A two- to three-year transition period will allow regulators to adjust them where needed as they are further developed and implemented.

Over time, the accumulated data and shared experience can support more systematic assessment of grid performance and innovation across Europe.

ACER publishes its multi-annual work programme 2026-2028

ACER publishes its multi-annual work programme 2026-2028

What is it about?

ACER has released its multi-annual programming document 2026-2028, outlining its strategic goals and priorities for the coming years, including its 2026 work programme.

Which are ACER’s priorities for 2026-2028?

ACER will continue its work on:

- the integration of EU energy markets;

- infrastructure, flexibility needs and security of supply;

- the integrity and transparency of the EU’s wholesale energy markets; and

- longer-term regulatory challenges (e.g. increasing price and geopolitical volatility, Russian gas phase out).

In 2026, ACER’s work will focus on the following priorities:

- REMIT framework to protect against market manipulation: ACER will continue to ensure that REMIT is fully implemented and hence reinforce trust that prices set in Europe’s wholesale energy markets reflect competitive forces and the underlying market fundamentals. The Implementing Regulation and delegated acts related to REMIT II will broaden the scope of market surveillance and the level of transparency of energy markets, while ACER will progressively conduct cross-border investigations, complementing national regulatory authorities’ work.

- Cross-border trade and energy security: ACER will support amendments to network codes for cross-border electricity and gas trade. In line with REPowerEU, ACER will monitor the phase-out of Russian gas imports to the EU, and contribute to key discussions on energy infrastructure, security of supply and flexibility.

- Market monitoring: ACER will continue monitoring the energy sector, identifying challenges and opportunities to increase consumer benefits from the integrated EU energy market.

The document was adopted on 12 December 2025 by ACER's Administrative Board, following the favourable opinion of the Agency's Board of Regulators.

Compensation for cross-border power losses fell in 2024 after the 2023 peak

Compensation for cross-border power losses fell in 2024 after the 2023 peak

What is it about?

ACER published its report on the implementation of the inter-transmission system operators compensation mechanism (ITC) for 2024.

ACER issues these yearly monitoring reports since 2012, as mandated by the Commission’s Regulation.

What is the ITC mechanism?

The inter-transmission system operators compensation (ITC) mechanism, managed by the European Network of Transmission System Operators for Electricity (ENTSO-E), compensates transmission system operators (TSOs) for the costs of hosting cross-border flows on their networks (including costs from power losses and infrastructure investments).

The mechanism works through the ITC fund: participating TSOs both contribute and receive money from it, depending on how much electricity they import, export and transmit across their national borders. The aim of the mechanism is to ensure that costs and benefits are fairly shared among the TSOs.

The ITC mechanism currently includes 36 TSOs from across the EU and neighbouring countries, including the Ukrainian TSO Ukrenergo, who officially joined the ITC agreement in July 2024.

What are the key findings for 2024?

- After increasing significantly in 2022 and 2023, the ITC fund fell from €1.14 billion in 2023 to €879.9 million in 2024, mostly due to a decrease in electricity wholesale prices (although these remain well above pre-crisis levels).

- As a result of lower wholesale prices, most TSOs (28 out of 36) saw lower loss costs compared to 2023. On average, weighted loss costs fell 28% to 145.97 €/MWh.

- As in previous years, the cost of losses varied widely among EU ITC parties, ranging from 63 to 259 €/MWh. Actual electricity losses also differed significantly across countries.

- ACER finds that the ITC mechanism in 2024 generally complies with EU legal requirements. However, it recommends further methodological improvements, in line with its Recommendation on the treatment of losses (2023), including calculating loss volumes in more detail and using actual loss costs.

What are the next steps?

ACER is currently reviewing existing EU mechanisms for sharing the costs and benefits of electricity network infrastructure arising from cross-border trade, including the ITC mechanism. The aim is to better reflect the EU-wide benefits of the grid and to facilitate infrastructure investments that extend beyond national interests and needs. The findings of this exercise will feed into an ACER policy paper in 2026.

ACER will consult on the design of REMIT exposure data reporting

ACER will consult on the design of REMIT exposure data reporting

What is it about?

In 2024, the revision of REMIT (Regulation on Wholesale Energy Market Integrity and Transparency) introduced new data reporting requirements, including the obligation to report exposure data, which shows how much market participants are exposed to price movements in wholesale energy markets.

At the same time, broader initiatives such as the Clean Industrial Deal and the EC consultation on the functioning of commodity derivatives and spot energy markets highlight the importance of simplifying and standardising data reporting.

As exposure data is a new and distinct reporting stream under REMIT, ACER will implement a new electronic template ‘Exposure XSD’ for its reporting, as set out in the revised REMIT and the recast REMIT Implementing Regulation.

Within this context, ACER is exploring whether the ‘ISO 20022 standard’, a common framework for exchanging data, could be applied to the ‘Exposure XSD’ reporting format, with the aim of making the reporting process simpler and more interoperable.

As a new reporting stream, the Exposure XSD is a suitable candidate that may benefit from the use of an existing standard. It is the only reporting format covered by this consultation, and no changes to existing REMIT reporting formats are being considered.

Your views matter

To support more harmonised reporting and to improve the interoperability of reported data, ACER will run a public consultation to gather input. Stakeholders are invited to share their views on the potential benefits of applying the ISO 20022 standard to the Exposure XSD reporting format.

The public consultation will run from 12 January until 9 February 2026.

Next steps

Based on the input received, ACER will assess whether to proceed with adopting the ISO 20022 standard for the Exposure XSD electronic format.

Technical specifications and detailed guidance on how to report exposure data in line with REMIT Implementing Regulation will be addressed in a separate consultation, to be launched after the revised Regulation enters into force.

ACER to decide on ENTSO-E’s European Resource Adequacy Assessment 2025

ACER to decide on ENTSO-E’s European Resource Adequacy Assessment 2025

What is it about?

On 17 December 2025, the European Network of Transmission System Operators for Electricity (ENTSO-E) submitted its proposal for the European Resource Adequacy Assessment (ERAA) 2025 to ACER.

What is ERAA?

Mandated by the 2019 Clean Energy Package, the ERAA is ENTSO-E’s annual evaluation of the risks to the EU’s security of electricity supply for up to 10 years ahead. Following the methodology approved by ACER in 2020, ENTSO-E must carry out an annual assessment on whether the EU has sufficient electricity resources to meet future demand.

At national level, Member States set their own electricity reliability standards to indicate the level of security of electricity supply they need. At European level, the ERAA verifies whether the EU’s electricity system can meet these national standards.

How does the ERAA benefit the EU?

The ERAA provides an objective basis for identifying potential risks to Europe’s security of electricity supply and for determining whether additional national measures, such as capacity mechanisms, are needed. It helps inform decisions by Member States and the European Commission (e.g. state aid decisions) on national security of electricity supply measures.

What are the next steps?

Every year, where necessary, ACER suggests how to improve the next ERAA before ENTSO-E begins its work (e.g. see ACER suggestions for the ERAA 2025). ACER also actively engages with ENTSO-E throughout the year.

ACER will review and decide on ENTSO-E’s proposed ERAA 2025 within three months of its submission.