year-on-year increase in gas storage injections in Q2 2025, narrowing the stock gap with previous years.

ACER webinar: Improving EU scenario development to meet future energy needs

ACER publishes today its first Recommendation on inter-temporal cost allocation mechanisms for financing hydrogen infrastructure. To ensure the recommendation is well-informed, ACER conducted a public consultation on the topic in spring 2025.

The EU aims to build a cost-effective hydrogen network to meet its climate goals. However, high infrastructure costs and demand uncertainty pose significant investment challenges, especially in the early stages of market development.

To address this issue, the EU Hydrogen and Decarbonised Gases Regulation (2024) grants Member States the authority to allow hydrogen network operators to recover infrastructure costs gradually over time through inter-temporal cost allocation mechanisms. These aim to ensure a fair and balanced distribution of costs between early and future consumers, ensuring that the former are not disproportionately burdened.

The regulation also assigns new hydrogen-related tasks to ACER, including issuing a recommendation to guide the development and implementation of inter-temporal cost allocation mechanisms. ACER’s Recommendation provides practical advice to support the rollout of hydrogen networks and ensure fair cost-sharing over the long term.

ACER’s Recommendation identifies key investment risks in hydrogen infrastructure and suggests ways to address them. It offers high-level guidance on designing fair and effective inter-temporal cost allocation mechanisms to support the development of the hydrogen market. ACER also highlights the need for Member States to promptly establish clear hydrogen regulatory frameworks and develop flexible national rules to accommodate the future EU-wide hydrogen network codes.

Given the early stage of the hydrogen market and the lack of established best practices, ACER does not yet propose a single, standardised EU-wide approach. Instead, it calls for:

ACER will review and update its Recommendation at least every two years, incorporating more refined guidance as the market evolves. The next publication is planned for 2027.

On 2 July 2025, ACER received a proposal from all electricity transmission system operators (TSOs) to amend the methodology for intraday cross-zonal gate opening and closure time.

Established under the Capacity Allocation and Congestion Management (CACM) Regulation, the methodology sets harmonised rules across EU Member States for when electricity trading can begin (gate opening time) and end (gate closure time) in the intraday market.

The intraday market is a short-term market where electricity is bought and sold on the same day as delivery (e.g. a few hours before), after the day-ahead market has closed. It allows participants to adjust their positions based on updated forecasts and balance supply and demand closer to real time.

By coordinating these timings across different bidding zones, the methodology supports market integration and the efficient use of cross-zonal capacity within the European electricity market.

TSOs propose harmonising the gate closure time at 30 minutes before real-time delivery, replacing the current standard of 60 minutes. The gate opening time would remain unchanged. This amendment aims to align the methodology with the requirements of the Electricity Market Design Reform (2024), which seeks to improve the efficiency of short-term markets.

Shortening the gate closure time is expected to:

ACER expects to decide on the amended methodology by 2 January 2026.

Interested parties are encouraged to submit comments or questions to ACER-ELE-2025-007@acer.europa.eu by 26 September 2025.

Europe’s clean energy shift is accelerating, and electricity distribution networks must keep pace. From integrating solar panels and electric vehicles to connecting heat pumps and storage, grids need to become more modern, flexible and resilient. To support this, the European Commission’s Action Plan for Grids tasked ACER and the Council of European Energy Regulators (CEER) with providing guidance on electricity distribution planning.

This guidance provides practical recommendations to help national distribution grid operators align with Europe’s decarbonisation goals and turn grid development into a driver, not a barrier, of the clean energy transition. By promoting more coordinated and inclusive planning, the guidance supports the EU Affordable Energy Action Plan, helping ensure the shift to clean electricity is not only sustainable and secure, but also fair and affordable for all Europeans.

Distribution networks link homes, businesses and renewables to the wider power grid. Yet most were built for one-way power flows, not today’s decentralised, more flexible generation and fast-growing demand for electricity.

As electrification and renewable growth accelerates, so do the risks of grid bottlenecks and infrastructure development delays. That’s why EU law requires distribution system operators to publish distribution network development plans to outline medium and long-term flexibility needs and investments planned for the next 5-10 years so that the full potential of renewables can be integrated.

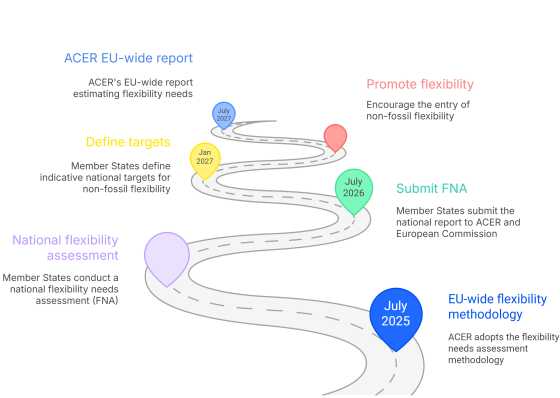

In a further step towards Europe’s clean energy transition, ACER approves the methodology to be used nationally for identifying non-fossil flexibility needs. This is an important step in developing a common European basis for integrating more renewable energy into the electricity grid and meeting the EU’s decarbonisation targets. This ACER decision directly supports the EU’s Clean Industrial Deal by laying the groundwork for a more resilient electricity system that can power a competitive, low-carbon economy.

The flexibility needs assessment methodology (FNAM), developed by the European Network for Transmission System Operators for Electricity (ENTSO-E) and the EU Distribution System Operators Entity (EU DSO Entity), and approved by ACER, will guide Member States' electricity network operators in identifying how much clean and flexible energy their country needs to handle the variability of demand and supply in their power system.

Clean flexibility is the energy system’s ability to adapt quickly to changes in electricity supply and demand, without relying on fossil fuels. It enables:

Unlocking clean flexibility will cut reliance on gas, enable energy transition in a cost -effective manner and help Member States deliver on the EU’s binding 2030 renewable targets (42.5%) and climate neutrality by 2050.

The methodology distinguishes between two main types of flexibility needs: network flexibility needs and system flexibility needs. Network flexibility reflects the flexibility needed to adjust for grid availability, whereas system flexibility refers to the ability of the electricity system to adjust both power generation and consumption in response to signals from the market.

The flexibility needs assessment methodology provides a harmonised approach for transmission and distribution system operators (TSOs and DSOs) in analysing the national flexibility needs in terms of:

This harmonised and unified approach serves both national and EU-wide estimations of flexibility needs, with results feeding into reports that will identify how much flexibility is needed, where and at what cost.

Each EU Member State shall now:

ACER will then publish an EU-wide report to estimate the flexibility needs including a set of recommendations on issues of cross-border relevance at EU level (July 2027).

This new methodology brings several important advancements to how Europe plans for flexibility, as it:

This coordinated approach is essential to delivering a climate-neutral power system, ensuring renewables are fully used.

Member States now have 12 months to prepare their national flexibility assessments. These reports will become vital tools in shaping clean energy investment decisions, grid expansion and modernisation and designing EU policy to accelerate flexibility deployment across borders.

Learn more about flexibility and ACER's work in this area.

On 2 July 2025, electricity transmission system operators (TSOs) submitted to ACER their proposal to amend how capacity calculation regions (CCRs) are defined across Europe. ACER is now gathering stakeholder views to inform its assessment.

CCRs are cross-border zones where neighbouring TSOs coordinate how much electricity can safely flow between them. This cooperation helps boost cross-border trade, prevent grid congestion and price spikes, and support a more secure, integrated European energy market.

There are currently nine CCRs in Europe: Nordic, Hansa, Core, Italy North, Central Europe (CE), Greece-Italy (GRIT), South-West Europe (SWE), Baltic and South-East Europe (SEE). They are key to ensuring efficient electricity use, especially as more countries and renewables come into play.

The TSOs are proposing:

ACER is assessing whether the TSOs’ proposal supports market integration, ensures efficient use of the grid and supports the well-functioning of the EU electricity market.

To make an informed decision, ACER is organising a public consultation from 24 July 2025 to 3 September 2025.

ACER aims to reach a decision by December 2025.

17 December 2025 update: With its Decision 10-2025, ACER has approved the proposed amendments.

Today, ACER publishes its fifth report on cross-border cost allocation (CBCA) decisions for electricity and gas infrastructure projects.

Covering 50 decisions made between 2014 and 2024, the report provides insights into how these decisions, issued by national regulators, determine the cost distribution of major cross-border projects and support project development.

Cross-border cost allocation is a mechanism designed to fairly distribute the investment costs of projects of common interest (PCIs) and projects of mutual interest (PMIs) among the countries involved. It aims to support project implementation, especially in cases where some countries would otherwise bear significantly higher costs than the benefits the project provides.

Project promoters submit investment requests to national regulatory authorities, who review them and issue CBCA decisions to determine how project costs should be shared among involved countries. This cost-sharing arrangement is required for projects to receive financial support through the Connecting Europe Facility (CEF), a major funding programme that supports the development of strategic infrastructure across Europe.

ACER monitors all submitted investment requests and decisions taken by national regulators and regularly reports on emerging trends.

ACER’s report shows:

ACER’s 2025 retail energy country sheets offer a concise overview of the national electricity and gas markets across EU Member States and Norway. For the first time, the country sheets cover both sectors, presenting:

ACER has also updated its retail pricing dashboard, which shows monthly changes in household energy prices across EU Member States and Norway from January 2019 to June 2025.

The country sheets complement ACER’s retail Monitoring Report (coming in November).

ACER’s retail pricing dashboard highlights the main trends in household electricity and gas prices.

Electricity prices across Europe stabilised by June 2025, ending the decline observed since early spring. Spain and Portugal recorded the sharpest monthly rises (+7% and +6%, respectively), followed by more moderate increases in Greece, the Netherlands, Italy and Austria. In contrast, prices declined in Norway (-7%), Estonia (-3%), and in Belgium, Latvia, Sweden and Lithuania (-2%). Most other countries recorded no change. On an annual basis, EU household electricity prices rose by approximately 3%.

Retail gas prices also remained largely stable, with minor monthly changes: Belgium and Portugal registered small increases (+1%), while Italy recorded the largest decrease (-4%), followed by France and Latvia (-2%), and the Netherlands, Estonia and Austria (-1%). While retail gas prices remained unchanged month-on-month in most Member States, retail offers were approximately 7% higher than those available during the same period last year.

What are the main trends in wholesale gas markets? Prices remained elevated year-on-year but showed little monthly change, despite volatility driven by global trade and security shocks. More information is available in ACER’s monitoring report on key developments in gas wholesale markets report, published today.

Published today, ACER’s latest report on key developments in European gas wholesale markets (Q2 2025) examines key trends in prices, supply and storage during the early months of the gas summer season. The analysis supports policy discussions on enhancing secure and competitively priced gas in Europe.

If current LNG inflows and storage injection levels continue, Europe is likely to enter winter with healthy reserves. Still, risks remain: extreme weather, disruptions to major supply sources, or geopolitical instability could alter the trajectory. On the supply side, the expected expansion of global LNG production in late 2025 and 2026 may help ease pressure.

Gas

Gas

This report provides insights into European gas wholesale markets during the early months (April to June 2025) of the gas summer season, highlighting main trends in gas supply, demand and market prices.

This analysis helps inform policies aimed at ensuring secure and competitively priced gas.

year-on-year increase in gas storage injections in Q2 2025, narrowing the stock gap with previous years.

year-on-year increase in EU LNG imports, driven by competitive prices and the ramping up of new liquefaction facilities.

drop in Russian pipeline gas to the EU after Ukraine transit expired.

ACER’s report on key developments in European gas markets (Q2 2025):