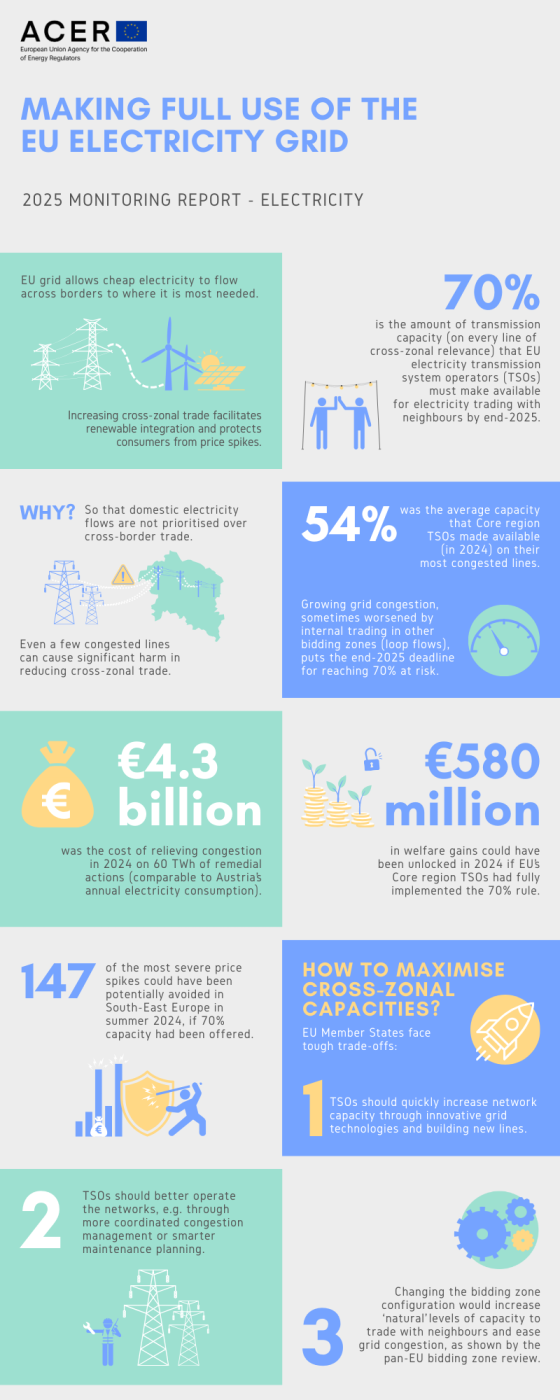

expected welfare gains had TSOs in the Core region made 70% of capacity available for cross-zonal electricity trade in 2024.

ACER welcomes updates to ENTSO-E’s Transparency Platform manual

ACER welcomes updates to ENTSO-E’s Transparency Platform manual

What is it about?

Today, ACER publishes its Opinion on the updated manual of procedures for the European Network of Transmission System Operators for Electricity (ENTSO-E) Transparency Platform, submitted on 8 July 2025.

What is the ENTSO-E Transparency Platform?

The ENTSO-E Transparency Platform is a key tool for collecting and centralising electricity data at the European level. It provides open access to information on electricity generation, transmission and consumption, supporting all market participants, including generators, retailers and traders.

Why an ACER opinion?

In line with the Transparency Regulation, ENTSO-E must maintain and update a manual of procedures for the Transparency Platform, defining the data formats, communication standards, technical and operational requirements for data providers, as well as production type classifications. The manual must be developed through stakeholder consultation and submitted to ACER for an opinion before any updates are published. To date, ACER has issued four Opinions on ENTSO-E’s manual.

What are ACER’s main takeaways?

ACER finds that the updated manual aligns with the objectives of the Transparency Regulation and related EU legislation. In its Opinion, ACER:

- Notes the addition of new data items and definitions, which improve the scope and accessibility of published data.

- Welcomes ENTSO-E’s efforts on addressing data quality issues.

ACER recommends further improvements to the manual, including:

- harmonising definitions of data items across legal frameworks;

- improving clarity of publications related to balancing and cross-zonal capacities;

- strengthening data quality on the platform; and

- considering feedback from previous ACER Opinions.

What’s next?

ENTSO-E should take ACER’s recommendations into account and proceed with publishing the final updated manual of procedures.