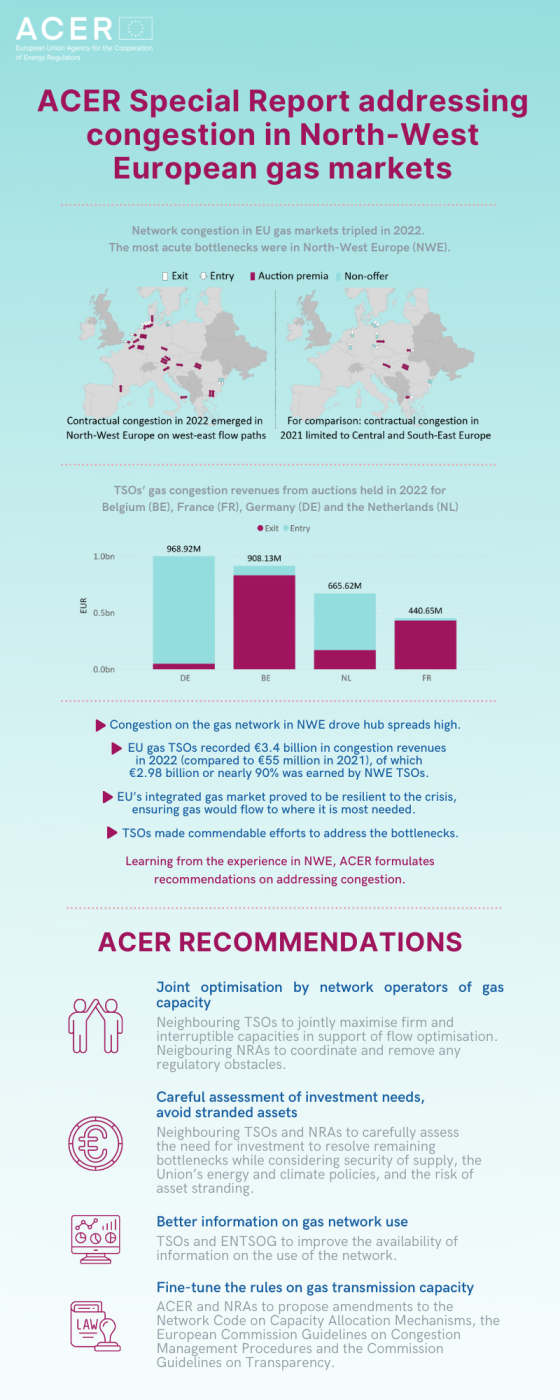

With gas markets being impacted by a global pandemic (2020) and a European energy crisis (2022), the resilience of the current market rules (also known as “network codes”) has been tested. Although they have mostly ensured a proper market functioning (see ACER’s Market Monitoring Reports and congestion reports), lessons have yet to be learned to further enhance market resilience.

The European gas market must also ensure its readiness to align with the latest policy and technological developments, guaranteeing that the decarbonisation targets set by the Green Deal can be met.

Against this background, the latest European Gas Regulatory Forum (also known as “Madrid Forum”) has recently emphasised the importance of having gas market rules which can adequately reflect this evolution, and therefore prompted for the revision of the Capacity Allocation Mechanisms Network Code (“CAM NC”).

What is the Capacity Allocation Mechanisms Network Code?

The rules for allocating gas transmission capacity have been in place since 2017, when the current version of the Network Code on Capacity Allocation Mechanisms was adopted.

These market rules harmonise how network users can utilise the gas transmission network to enter or exit a market, and how these capacity rights can be obtained.

What is the role of ACER?

As a first step, ACER is planning a public consultation (opening on Tuesday 14 November 2023) and workshop (on Tuesday 12 December 2023) to take stock of what works under the current market rules and collect views from stakeholders on the way forward.

ACER will benefit from this information when it may recommend amendments to the CAM NC in the course of 2024.

What are the next steps? Save the dates!

ACER is launching a public consultation on the “Capacity Allocation Mechanisms Network Code: achievements and the way forward”, which will run from Tuesday 14 November 2023 until Friday 5 January 2024.

On Tuesday 12 December 2023, ACER will also organise an online workshop on the same topic. Registrations will open on Tuesday 14 November 2023.

The event aims to:

ACER also intends to publish a policy paper, tentatively in the first quarter of 2024, to follow up on any identified areas of improvement. This policy paper will be a first input when the formal review of the CAM NC may be launched in the course of 2024.