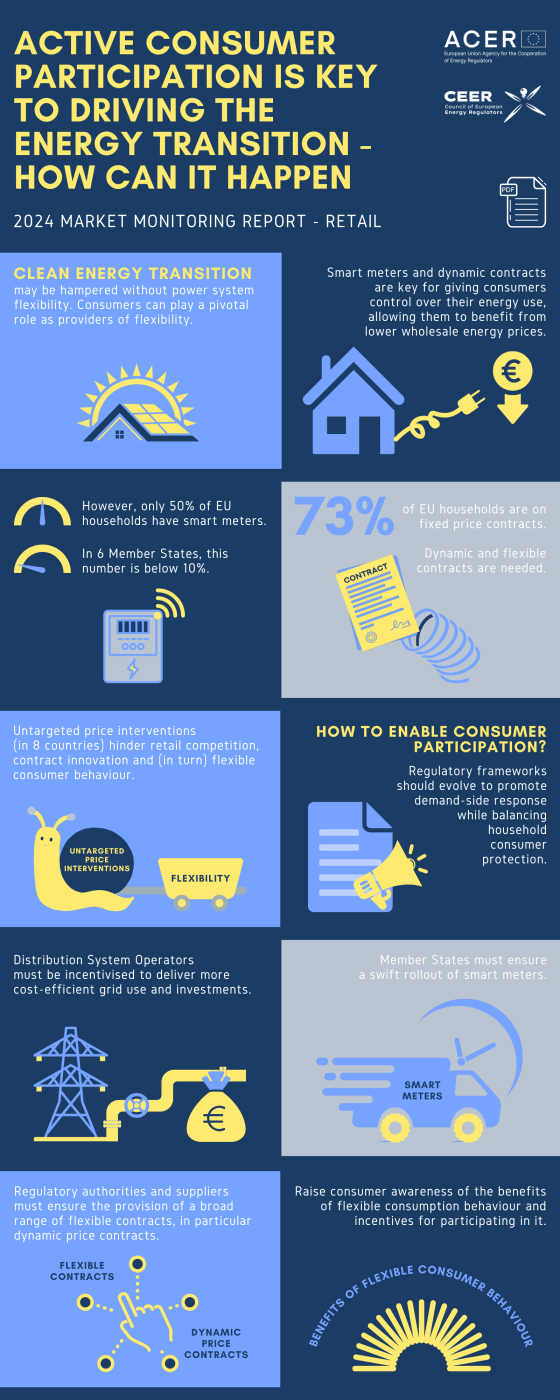

of household electricity consumers

are on fixed and inflexible contracts

REMIT breach: Spanish energy regulator fines Neuro Energía y Gestión €1+ million for electricity market manipulation

REMIT breach: Spanish energy regulator fines Neuro Energía y Gestión €1+ million for electricity market manipulation

What is it about?

The Comisión Nacional de los Mercados y la Competencia (CNMC) has imposed a €1,081,502 fine on Neuro Energía y Gestión for manipulating the Spanish electricity market between 23 August 2022 and 15 March 2023.

This penalty comes under the REMIT Regulation (EU) No 1227/2011, which prohibits market manipulation and seeks to protect the integrity and transparency of the EU’s wholesale energy markets.

In its decision, CNMC found that Neuro Energía y Gestión had breached Article 5 of REMIT, specifically Article 2.2.a.i by:

- Issuing and withdrawing non-genuine orders to be in an advantageous position to execute cross-border sales with France.

- Manipulating the market by providing false or misleading signals as to the supply, demand, and price of wholesale energy products.

The investigation revealed that Neuro Energía y Gestión, in 125 trading sessions, issued and withdrew non-genuine orders using the digital certificates of 34 other market agents. The goal was to control the offer processing queue on the continuous intraday electricity cross-border sales contracts with France.

ACER welcomes this decision by CNMC, which seeks to promote the transparency and integrity of the Spanish electricity market.

Access the Decision and CNMC’s press release (both in Spanish).

See the latest table of REMIT breach sanction decisions adopted by national regulatory authorities.

Check the ACER REMIT Guidance (6th edition) for more information on the types of trading practices which could constitute market manipulation under REMIT.

Interested in further information on enforcement decisions under REMIT? Check out ACER’s REMIT Quarterly reports.