ACER amends the methodology for the electricity market coupling algorithm to mandate research on co-optimisation

ACER amends the methodology for the electricity market coupling algorithm to mandate research on co-optimisation

What is it about?

In November 2023, ACER received a proposal from Nominated Electricity Market Operators (NEMOs) for amending the ACER’s 2020 methodology for the price coupling algorithm and the continuous trading matching algorithm.

The methodology sets the regulatory framework for:

- the algorithms used for matching orders; and

- allocating cross-zonal capacities in the European day-ahead and intraday electricity markets.

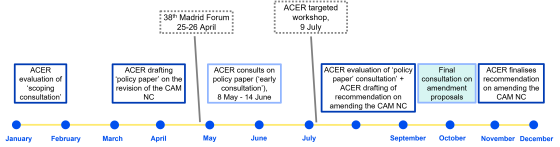

After consulting with stakeholders (in winter and spring) and hosting two webinars (in February and June), ACER made revisions to the NEMOs’ initial proposal. Today, with its Decision 11-2024, ACER has adopted the amended methodology.

What’s new?

The updated methodology, in particular the day-ahead coupling algorithm, enables the investigation of a co-optimised allocation of cross-zonal capacity (‘co-optimisation’). This approach would allow the efficient sharing of the available cross-zonal capacity between energy trading and exchanges linked to balancing services, facilitating the integration of balancing capacity markets.

Research will identify the best co-optimisation approach

ACER’s Decision requires NEMOs, in collaboration with Transmission System Operators (TSOs), to conduct the necessary research and development (R&D) activities to fully understand the technical feasibility, impacts, and implications of integrating co-optimisation into the price coupling algorithm. This R&D work will be structured around four milestones and is expected to finish in November 2026.

ACER expects the R&D outcomes to provide sufficient information to determine the best approach for implementing co-optimisation and estimate a realistic timeline for its introduction in the day-ahead electricity market.

What are the next steps?

After the required R&D activities are finalised, ACER will analyse the findings and discuss their implications with NEMOs and TSOs. Based on these discussions and if required, ACER may request further amendments to the algorithm methodology and related Terms, Conditions and Methodologies (TCMs).