ACER amends the congestion income distribution methodology

ACER amends the congestion income distribution methodology

What is it about

ACER approves today the proposal received by Transmission System Operators (TSOs) to amend the congestion income distribution methodology in the European electricity markets.

What is the congestion income distribution methodology?

Congestion arises when there is limited capacity to transport electricity between different areas. When a congestion occurs, a price difference emerges between the different bidding zones which generates congestion income. The congestion income distribution methodology describes how to distribute such income among TSOs to ensure fairness and efficient operation of the electricity market.

Why the need to amend the methodology?

There are two main reasons for amending the methodology:

-

Several mechanisms (such as flow-based allocation or advanced hybrid coupling) have recently been or will soon be implemented to increase the efficiency of the market coupling. However, these mechanisms can cause unintuitive flows (electricity flows from an expensive zone to a cheaper one). This amendment aims to address the financial consequence of unintuitive flows and to ensure a non-discriminatory treatment of all TSOs.

-

In the future, exchange of balancing capacity or sharing of reserve will be implemented. Both mechanisms would generate congestion income that need to be distributed. This amendment will regulate how congestion income will be distributed among TSOs.

What are the next steps?

Following ACER’s approval of the methodology, European TSOs will implement the required changes.

ACER amends the harmonised allocation rules for long-term electricity transmission rights

ACER amends the harmonised allocation rules for long-term electricity transmission rights

What is it about?

On 22 December 2023, with its Decision 18/2023, ACER approved the proposal of the Transmission System Operators (TSOs) to amend the Harmonised Allocation Rules (HAR) for long-term electricity transmission rights.

What is it about?

On 1 March 2023, ACER received the TSOs’ proposal for amending the HAR for long-term transmission rights under the Regulation on forward capacity allocation. On 1 August 2023, the TSOs completed their proposal with amendments to the provisions on collaterals.

To take an informed decision, ACER engaged with stakeholders through a public consultation and a workshop in summer 2023.

Why were the rules amended?

Amending the HAR was needed to introduce the flow-based allocation of long-term transmission rights and enable cross-zonal coordination. This will make the long-term electricity market more efficient and aligned with the day-ahead market design.

Flow-based allocation of long-term transmission rights is a mechanism that efficiently allocates cross-border transmission capacity in the electricity market. It takes into account the physical reality of the transmission network by calculating the available capacities of physical network elements for electricity exchanges between different areas, as well as sensitivity factors.

A flow-based mechanism enables cross-zonal coordination in the long-term electricity markets, which provides more accurate price signals for cross-border trade, reduces market distortions and ensures that the prices reflect the true cost of generating and transmitting electricity.

The amendment of the HAR allows for the implementation of two projects for long-term flow-based capacity calculation and allocation in the Core and Nordic capacity calculation regions. The HAR revision was the final step needed for the implementation of these projects, following ACER’s approval of other related methodologies in March 2023.

What are the next steps?

The amended HAR will apply from the date specified in the amendment notice published by the Joint Allocation Office.

ACER has decided not to propose alternative electricity bidding zone configurations in the Baltic region

ACER has decided not to propose alternative electricity bidding zone configurations in the Baltic region

What is it about?

ACER has reached a decision that no alternative electricity bidding zone configurations need to be investigated in the Baltic region. The procedure to decide started on 26 September 2023.

What are the bidding zones?

A bidding zone is the largest geographical area within which market participants can exchange energy without allocating capacity. Currently, bidding zones in Europe are mostly defined by national borders. However, the existing European electricity target model requires defining bidding zones based on network congestions. Hence, the need for alternative bidding zone configurations has to be examined.

What are the Decision’s main highlights?

ACER’s Decision is based on the feedback received from stakeholders in 2021, as well as on the following information provided by Transmission System Operators (TSOs):

- the alternative configurations previously submitted to ACER; and

- the outcome of locational marginal pricing simulations (following the bidding zone review methodology approved in November 2020).

ACER concludes that the current bidding zone configuration in the Baltic region is adequate, and no alternatives should be sought with priority. Nonetheless, this conclusion does not preclude the possibility to investigate potential mergers of the Baltic bidding zones in future reviews.

ACER grants regulators more time to agree on the amendment to the Core day-ahead electricity capacity calculation methodology

ACER grants regulators more time to agree on the amendment to the Core day-ahead electricity capacity calculation methodology

What is it about?

On 24 October 2023, the National Regulatory Authorities (NRAs) of the Core Capacity Calculation Region (CCR) requested from ACER an extension to agree on the Core Transmission System Operators’ (TSOs’) proposed second amendment to the Core day-ahead electricity capacity calculation methodology.

On 20 December 2023, with its Decision 15/2023, ACER granted an extension of three months to the Core CCR NRAs (Austria, Belgium, Croatia, Czech Republic, France, Germany, Hungary, Luxembourg, the Netherlands, Poland, Romania, Slovakia and Slovenia).

What is the methodology about?

The day-ahead capacity calculation methodology describes the rules of each CCR on how to calculate the amount of capacity available for trading between bidding zones at day-ahead market time frame.

What are the NRAs asked to decide about?

The TSOs’ proposal suggests an implementation of the Advanced Hybrid Coupling (AHC) aiming at reducing the volume of unscheduled allocated flows on the Critical Network Elements with Contingencies (CNECs) of the Core CCR. These unscheduled flows result from electricity exchanges on the bidding zone borders of adjacent CCRs.

What are the next steps?

The Core NRAs have until 6 February 2024 to decide on the TSOs’ proposal for the second amendment to the Core day-ahead capacity calculation methodology.

Council (TTE) reaches political agreement to extend the gas market correction mechanism

Council (TTE) reaches political agreement to extend the gas market correction mechanism

What is it about?

The EU energy ministers agreed to extend the gas market correction mechanism (MCM) for a period of one year, until 31 January 2025.

Ministers at the Transport, Telecommunications and Energy (TTE) Council meeting (19 December 2023) reached a political agreement to extend the period of application of three Council regulations (adopted in December 2022) designed for emergency situations, including the gas MCM (see the Council's press release).

Next, the Council will aim to formally adopt the regulations by written procedure.

What is the gas market correction mechanism?

The MCM Regulation (December 2022) established a gas MCM to protect EU citizens and the economy against excessively high energy prices. It entered into force on 1 February 2023, initially for a period of one year, and tasked ACER with the calculation and publication of the MCM reference price.

ACER welcomes ENTSO-E’s Winter Outlook and stresses the value of coordinated analysis for the European security of electricity supply

ACER welcomes ENTSO-E’s Winter Outlook and stresses the value of coordinated analysis for the European security of electricity supply

What is it about?

Ahead of every winter and summer, the European Network of Transmission System Operators for Electricity (ENTSO-E) assesses the potential risks to the European security of electricity supply for the six months ahead. This analysis allows Transmission System Operators (TSOs) and Member States to take relevant actions and ensure the European consumers are supplied without interruption.

What are the risks this winter?

ENTSO-E’s Winter Outlook 2023-2024 finds that the situation in the European power system for this winter is more secure than last year.

- Risk of power interruption appears in the islands of Ireland, Malta, and Cyprus – a pattern that has repeated in past seasonal outlooks. With limited interconnections, islands need to rely mostly on their own resources. This highlights the major role played by interconnectivity in the security of supply. Finland may also face risk in the event of exceptionally adverse conditions.

- Regional risks: the Outlook also identified a potential risk associated with a surge in French demand, triggered by the drop in temperatures. This demand increase could impact Belgium and Great Britain, showcasing the importance of effective coordination to solve potential regional risks.

What does ACER say?

- Continuing good practice: ACER appreciates that the Winter Outlook continues to analyse the electricity saving potential and the critical gas volume needed to ensure security of electricity supply. This addition provides complementary information to Member States, system operators, and other stakeholders to take relevant actions.

- Collaboration with Ukraine and Moldova: ACER welcomes the enhanced cooperation efforts with the Ukrainian and Moldovan system operators. These efforts contribute to reducing the system risks following Russia’s invasion of Ukraine and addressing the challenges faced.

- Improve the methodology: ACER stresses the methodological gap persisting in the seasonal outlooks, as highlighted in the last opinions. Particularly, ENTSO-E does not apply the flow-based market coupling in its model, although it has already been in place for several years, helping the Transmission System Operators (TSOs) to allocate cross-border capacities more efficiently. Without this approach, the forecasts may diverge from real outcomes and from national seasonal assessments.

ACER proposes amendments to the electricity grid connection network codes

ACER proposes amendments to the electricity grid connection network codes

What is it about?

Today, ACER has submitted to the European Commission its Recommendation on the amendments to the network codes on requirements for grid connection of generators (RfG Regulation) and on demand connection (DC Regulation).

The RfG Regulation and DC Regulation are the electricity grid connection codes, designed to establish and maintain the physical connection between the transmission and/or distribution grids and the grid users.

The RfG Regulation sets out the common standards that generators must respect to connect to the grid. The DC Regulation establishes binding rules for electricity system users.

Why review the network codes?

In September 2022, in the framework of the Grid Connection Stakeholders Committee, the European Commission tasked ACER to propose amendments to the grid connection network codes. The purpose of these amendments was to enhance the Regulations by making them more ‘future-proof’ and reflecting the latest developments in the electricity and transport sectors (e.g. including electricity storage, electromobility, heat-pumps and power-to-gas demand units, etc.).

To inform its drafting, ACER engaged with stakeholders on several occasions:

- First public consultation (Autumn 2022)

- Workshop on the amendments to the grid connection network codes (Autumn 2022)

- Workshop on electromobility, power-to-gas demand units and heat-pumps (Spring 2023)

- Workshop on rate of change of frequency and grid forming capabilities (Spring 2023)

- Workshop on electricity storage (Spring 2023)

- Webinar on the amendments to the grid connection network codes (Summer 2023)

- Second public consultation (Summer 2023)

A first review of the inputs received was conducted by ACER and the National Regulatory Authorities (NRAs). The proposals were then discussed with the European Network of Transmission System Operators for Electricity (ENTSO-E), EU Distribution System Operators (DSOs) Entity and other stakeholders to finalise the Recommendation.

What are ACER’s main recommendations?

RfG Regulation:

- Update definitions and expand scope of application to include new electricity storage and electric vehicles;

- Introduce criteria for significant modernization of the power generating modules following the TSOs’ proposals and regulatory approval;

- Define new requirements for various types of electric vehicles, along with associated supply equipment (such as charging parks), and electricity storage modules.

DC Regulation:

- Update definitions and expand scope of application to include new electric vehicles and associated supply equipment as well as power-to-gas units and heat pumps;

- Introduce criteria for significant modernization of existing transmission-connected demand facilities, transmission-connected distribution facilities, distribution systems and demand units used to provide demand response services following TSOs’ proposals and regulatory approval;

- Introduce amendments to requirements for transmission-connected demand facilities and distribution systems.

What are the next steps?

According to the Electricity Regulation, the European Commission will consider the recommendations made by ACER and adopt the two network codes, as a final step.

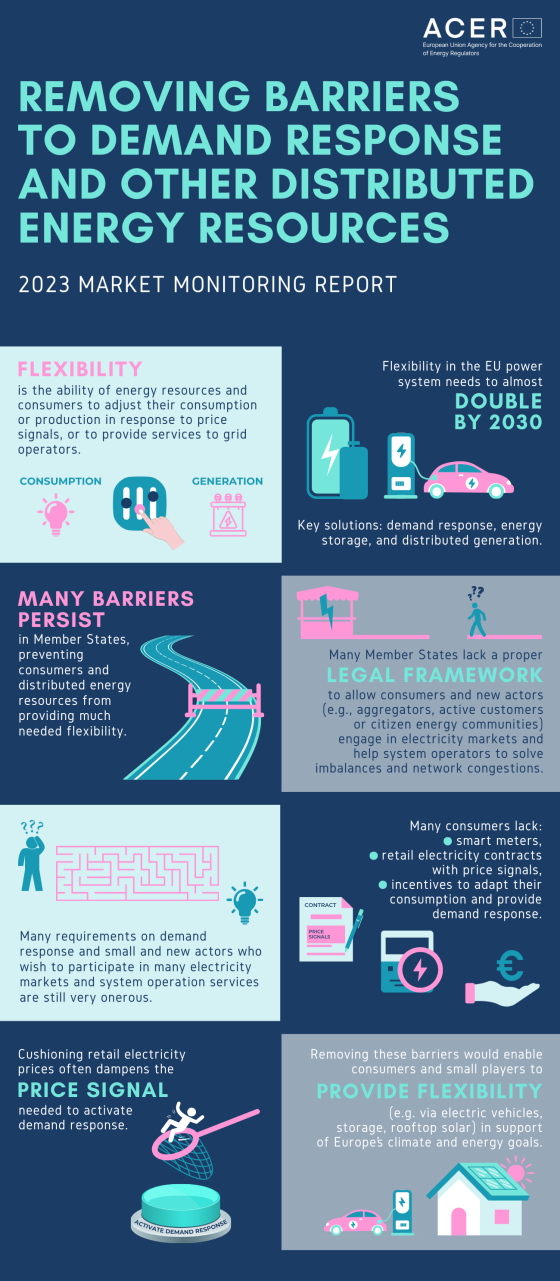

ACER offers a to-do list to remove the barriers that hinder demand response, new entrants and small players

ACER offers a to-do list to remove the barriers that hinder demand response, new entrants and small players

What is it about?

Today, ACER publishes its report on monitoring the barriers to demand response and other distributed energy resources, which is part of the 2023 Market Monitoring Report (MMR) series.

ACER makes specific recommendations that can help governments, regulators and network operators to remove the barriers that are holding back demand response and distributed energy resources in their countries. Removing these barriers would enable consumers and small players (e.g. electric vehicles, new storage solutions, rooftop solar) to actively participate in the electricity markets and help system operators to solve imbalances and network congestions providing much needed flexibility in support of Europe’s climate and energy goals.

What is the ACER report about?

This report identifies the main regulatory barriers and market restrictions that hindered the participation of distributed energy resources (i.e., demand response, energy storage and distributed generation) in the European wholesale electricity markets and system operation services in 2022.

Why is it so critical to leverage energy savings and small energy players?

The recent energy crisis showed how shifting and reducing electricity demand plays a crucial role when electricity supply is scarce or at risk. Europe’s ambition to be a carbon neutral continent by 2050 also means that a massive rollout of renewables is needed. Flexibility in the power system must double to keep pace with renewables. As the supply side increasingly fluctuates (with variable renewables) one important source of flexibility is the electricity consumers (also called “demand side”) and other small and distributed resources (e.g. batteries or rooftop solar).

The European Commission’s assessment of the draft updated National Energy and Climate Plans (18 December 2023) points out that going forward, the demand side of the electricity sector and energy storage are insufficiently covered despite the growing importance of flexibility.

What are the key findings of ACER’s barriers to demand response report?

- Many barriers to demand response persist (e.g. difficulties to access markets, lack of national rules, some retail electricity prices do not send proper price signals, etc.). Collectively, these significantly impact the market. Incentivising demand response should remain a priority for policy makers.

- Price spikes signal opportunities: price spikes and negative prices are more and more frequent, sending clear signals on when and where there is a need to increase supply or cut or shift demand.

- A proper legal framework for new actors to enter the electricity markets and system operation services is still missing in many Member States.

- Many consumers still need smart meters and incentivising retail electricity contracts to cut or shift their energy consumption.

- There is limited participation of distributed energy resources (e.g. consumers or batteries) in balancing services, congestion management services and capacity mechanisms.

- Some retail markets are not sufficiently open to new actors and competition.

- Some retail price interventions dampen price signals needed to activate demand response. On top of the price interventions introduced as emergency measures in response to the energy crisis, at least thirteen Member States have interventions in the retail electricity prices that predated the energy crisis. Most do not provide signals for demand response activation.

- Since 2020, some progress has been made in several countries (e.g. improving their national legislation, relaxing some requirements to provide balancing services or making their capacity mechanisms more inclusive).

What are ACER’s recommendations?

The ACER report presents key findings and specific recommendations. Broadly, this includes 9 recommendations to Member States, regulators, transmission system operators and distribution system operators, including to:

- Speed up implementing regulatory changes to remove persistent barriers to electricity consumers and other new entrants and small players.

- Accelerate the roll-out of smart meters, provide proper price signals in electricity bills contracts and raise consumer awareness to activate demand response.

- Ensure that local markets for congestion management have a chance to develop and mature. Define a transparent national process to assess when/where local markets may be implemented.

- Facilitate new entrants’ access to retail energy markets.

- Be targeted, tailored and temporary when considering retail price interventions.

In line with the ACER-EEA’s flexibility report (published in October 2023), ACER also recommends that Member States collaborate to unlock flexibility and enhance security of supply, while also supporting long-term goals for climate neutrality.

What are the next steps?

From 19 December 2023 until 2 February 2024 ACER is running a public consultation to gather inputs on the prioritisation of strategies for overcoming barriers to demand response.

On 19 January 2024, ACER will also organise a webinar to present its report on barriers to demand response and discuss with stakeholders.