ACER workshop on Capacity Allocation Mechanisms Network Code: achievements and the way forward

On 26 September 2023, ACER initiated a procedure to decide on the Transmission System Operators’ (TSOs) proposal on the alternative bidding zone configurations for the Baltic region. After having received the results of the Locational Marginal Pricing (LMP) analysis carried out by the Baltic TSOs, ACER is now in a position to start this decision-making process.

A bidding zone is the largest geographical area within which market participants are able to exchange energy without allocating capacity. Currently, bidding zones in Europe are mostly defined by national borders. However, the existing European electricity target model requires defining bidding zones based on network congestions. Better defined bidding zone configurations, i.e. whose borders are based on long-term, structural congestions, can bring several benefits, including:

increased opportunities for cross-zonal trade,

more efficient network investments, and

cost-efficient integration of new technologies.

To initiate the review process, all involved TSOs need to submit a proposal for:

the methodology and assumptions that should be used, and

the alternative configurations of bidding zones that relevant national regulatory authorities (NRAs) should analyse and approve unanimously.

The bidding zone review process initiated in October 2019; however, the TSOs’ initial proposal lacked alternative bidding zone configurations for a large part of Europe. They were therefore requested by the NRAs to submit an updated version of the proposal, which was then referred to ACER for decision (July 2020).

As a following step, ACER issued two separate decisions:

In November 2020, ACER approved the bidding zone review methodology and assumptions, and requested TSOs to carry out an LMP analysis.

In August 2022, following provision of information, ACER decided on the alternative bidding zone configurations to be analysed in the review process for all EU Member States, except for those of the Baltic region. This decision was deferred due to lack of data.

Following the submission of the results of the LMP analysis by the Baltic TSOs, ACER is now able to decide also on the alternative bidding zone configurations for the Baltic region.

ACER will adopt this decision by 26 December 2023.

To take an informed decision, ACER will consult with TSOs and NRAs.

ACER publishes today its Opinion on the draft regional lists of proposed electricity projects of common interest (PCIs) and projects of mutual interest (PMIs).

PCIs were introduced by the 2013 TEN-E Regulation. PCIs are infrastructure projects which benefit from accelerated permitting procedures and funding as they are identified as key contributors to achieving the EU’s energy and climate objectives, as set by the European Green Deal. The recent 2022 revision to the TEN-E Regulation introduced hydrogen projects as an eligible category for PCI status (see ACER Opinion on the draft regional lists of proposed hydrogen PCIs/PMIs 2023).

The revision also introduced the concept of PMIs. These are projects promoted by the EU in cooperation with third countries and are recognised as enabler of the energy transition (and therefore also benefit of accelerated permitting procedures).

The list of PCIs and PMIs is constructed by the European Commission and the Member States every two years. This is the first list under the revised Regulation.

Under the TEN-E Regulation, ACER:

provides input to the Regional Groups during the assessment of candidate projects in coordination with National Regulatory Authorities (NRAs), and

assesses the draft regional lists and provides an Opinion to the Commission on the consistent application of the criteria and the cost-benefit analysis (CBA) across regions.

ACER’s Opinion identifies three key areas of improvement:

Selection process: the selection process would benefit from ensuring that the Ten-Year Network Development Plan (TYNDP) is finalised before the assessment of PCIs and PMIs starts, as well as from greater transparency. The latter can be achieved by:

Releasing all key data and information to stakeholders before the project assessment starts.

Making the comments received in the public consultation on the candidate projects publicly available.

Informing stakeholders about the key elements of the methodologies used for the selection, and consulting with them in a timely manner.

Clearly explaining the reasoning for the inclusion or exclusion of the candidate projects from the draft PCIs and PMIs lists in the document submitted to ACER.

How infrastructure needs are identified: base the discussion on the identification of infrastructure needs on the ENTSO-E’s needs analysis and calculations – e.g. the needed target capacities per border.

Selection methodology: ACER proposes that the selection methodology could be improved by:

Considering multiple scenarios for the assessment.

Introducing a simplified methodology for assessing those projects that are in their early stages.

Using the monetised benefits as a basis of the methodology, while other drivers, such as the fulfilment of wider EU policy objectives, could be considered as a separate step.

ACER concludes that it is unable to assess the consistent application of the criteria of the TEN-E Regulation and the cost-benefit analysis across all the candidate projects. This is due to the lack of transparency in the implementation of the selection methodology and the lack of consideration of multiple planning scenarios.

ACER’s Opinion will be taken into consideration by the Regional Groups to finalise the PCIs/PMIs list. The Commission will then decide on the list by 30 November 2023.

ACER publishes today its Opinion on the draft regional lists of proposed hydrogen projects of common interest (PCIs) and projects of mutual interest (PMIs).

PCIs were introduced by the 2013 TEN-E Regulation. PCIs are infrastructure projects which benefit from accelerated permitting procedures and funding as they are identified as key contributors to achieving the EU’s energy and climate objectives, as set by the European Green Deal.

The TEN-E revision (2022) introduced the concept of PMIs. These are projects promoted by the EU in cooperation with third countries and are recognised as enabler of the energy transition (and therefore also benefit of accelerated permitting procedures).

Under the TEN-E Regulation, ACER:

Provides the Regional Groups with input during the assessment of candidate projects in coordination with National Regulatory Authorities (NRAs) and

assesses the draft regional lists and provides an Opinion on the consistent application of the criteria and the cost-benefit analysis (CBA) across regions.

This year, the Commission will adopt the first PCIs/PMIs list since the 2022 revision of the TEN-E Regulation. For the first time, the list includes hydrogen infrastructure as an eligible PCI category. The hydrogen sector holds considerable potential for shaping the future energy landscape. Its introduction as a PCIs/PMIs category has resulted in the submission of numerous hydrogen projects for PCI/PMI status.

In our Opinion, we delve into the 2023 PCIs/PMIs selection process, pointing out challenges faced within it and providing recommendations for the future selection rounds (happening in 2025).

ACER’s Opinion identifies three key priorities:

Identifying the needs: identifying hydrogen infrastructure needs poses its own specific complexities. As the hydrogen industry is in its early stages, assessing the future demand is difficult. Identification of needs would benefit from a more advanced methodology with more precise data inputs. ACER recommends Regional Groups dedicate more effort to tailor a robust process that anticipates the hydrogen sector’s growth.

Creating an effective selection methodology: developing a selection methodology that takes into consideration the unique uncertainties and specificities of the hydrogen demand and supply, needs to be a priority. ACER recommends synchronizing the finalisation of the Ten-Year Network Development Plan (TYNDP) process with a start of the PCIs/PMIs selection process and incorporate a hydrogen-specific CBA (see ACER Opinion on the draft ENTSOG CBA methodology of hydrogen infrastructure projects). ACER also recommends adopting an approach which considers various scenarios, aligned with the EU targets, to ensure a more comprehensive project assessment.

Ensuring greater transparency and data availability: ACER highlights the need for greater transparency in the application of the selection methodology for candidate projects. Sharing results transparently with Regional Group members promotes a shared understanding and enables informed decision-making. ACER observes also other challenges of this process, such as the unavailability of project-specific CBA results and the limited competence of National Regulatory Authorities in hydrogen, that prevents ACER to make a comprehensive assessment under the current TEN-E Regulation criteria.

ACER concludes in its Opinion that is unable to assess the consistent application of the foreseen selection criteria and the cost-benefit analysis of all candidate projects as outlined above.

ACER’s Opinion calls for improvements in the next PCIs/PMIs selection process (happening in 2025), namely:

more transparency;

more precise methodologies and coherency in their application; and

timely synchronization between the TYNDP process and the PCIs/PMIs selection process.

As ACER acknowledges these questions are adding complexity, it believes addressing them in the next PCIs/PMIs selection process is key to build a robust and future-proof hydrogen sector.

See also our Opinion on the proposed electricity PCIs/PMIs, published today.

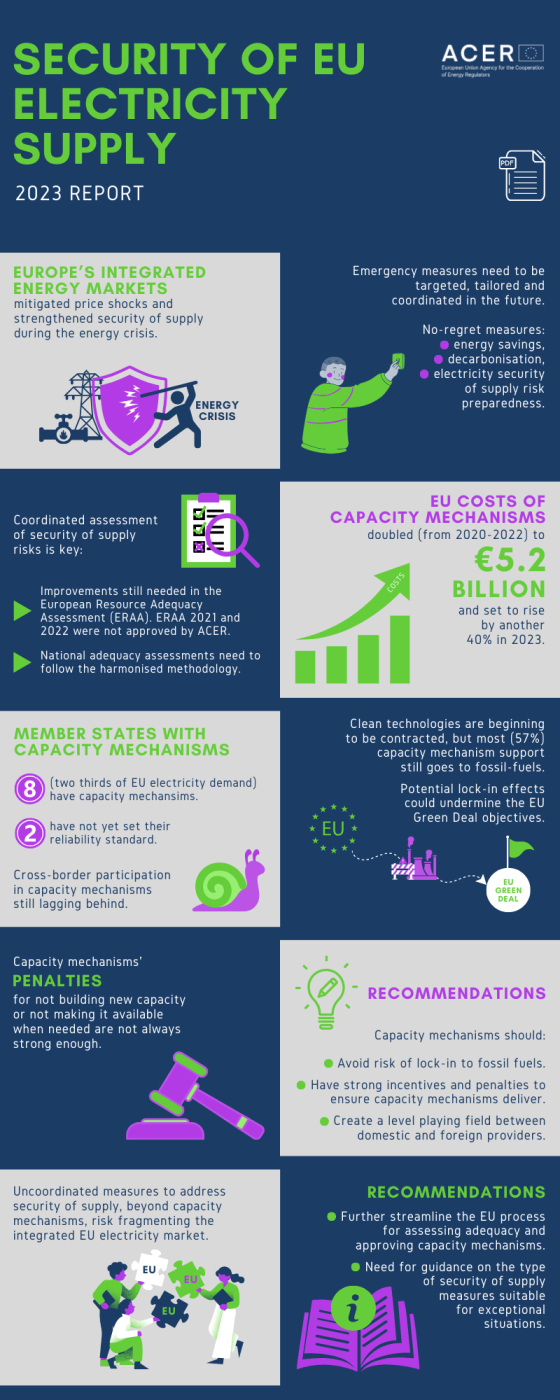

Today, ACER releases the 2023 report on the security of EU electricity supply.

The report looks into four main areas:

The report provides recommendations on improving Europe’s security of EU electricity supply framework.

ACER will present the key messages of the security of EU electricity supply report at its webinar on 11 October 2023.

High-level panellists Catharina Sikow-Magny (DG-ENER), Christian Zinglersen (ACER) and Tim Schittekatte (Florence School of Regulation) will discuss the findings of the report and address key questions on the topic.

Access the Security of EU electricity supply report.

Dive into ACER's informative infographic.

Explore the monitoring data on security of electricity supply.

ACER publishes today an Opinion on the European Network of Transmission System Operators for Gas' (ENTSOG's) draft cost-benefit analysis (CBA) methodology for hydrogen infrastructure.

ENTSOG is required by the TEN-E Regulation (2022) to draft the CBA methodology for hydrogen infrastructure projects.

ENTSOG’s CBA methodology should allow for a comparison between the costs and expected benefits of the infrastructure projects in a clear and unbiased way. It is a useful tool for decision-makers to understand the merits of hydrogen infrastructure projects.

In particular, the project-specific CBA assessments are used to evaluate projects in:

the European ten-year network development plans (TYNDPs);

the selection process of projects of common interest (PCIs); and

decisions on cross-border cost allocation (CBCA) of PCIs.

ACER’s Opinion:

Reviews ENTSOG’s development and consultation process that led to the draft methodology.

Assesses whether the draft CBA methodology is compliant with the TEN-E Regulation and its consistency with other CBAs methodologies.

Provides ENTSOG with recommendations that need to be considered before submitting the draft CBA methodology to the European Commission for approval (expected by the end of 2023).

ACER concludes that the draft CBA methodology for hydrogen infrastructure projects largely aligns with the requirements outlined in the TEN-E Regulation.

However, ACER recommends ENTSOG to consider improvements in the following areas:

Making CBA results more understandable to project evaluators by adding examples of the application of the CBA methodology to fictional hydrogen infrastructure projects.

Adapting the hydrogen reference networks.

Strengthening clustering rules and aligning them with ACER’s position paper (towards greater consistency of cost benefit analysis methodologies) while allowing some flexibility in the implementation for the next TYNDP 2024.

Improving the consistency with other CBA methodologies foreseen in the TEN-E Regulation (e.g. in reference to parameters such as the social discount rate (SDR), the timeline of analysis and the use of residual value).

Enhancement of the CBA indicators to ensure they are fit-for-purpose. More clarity is needed on how dual assessments are performed and for which indicators.

Improved assessment of the security of supply impacts. Different values for the costs of disruption for natural gas (CoDG) and for hydrogen (CoDH) should be used.

Application of the CBA methodology for all TYNDP projects.

ACER’s recommendations aim to improve the CBA methodology, making it more effective and transparent in evaluating the merits of hydrogen infrastructure projects.

In line with the TEN-E Regulation, ENTSOG is required to take into account ACER’s recommendations before submitting an adapted version of the methodology to the Commission for approval (by the end of 2023).

Stay tuned for further developments in hydrogen infrastructure such as ACER’s upcoming Opinion on the draft regional lists of proposed hydrogen PCIs.

ACER invites you to the 7th REMIT (Regulation on Wholesale Energy Market Integrity and Transparency) Forum – REMIT II: Improving integrity and transparency in wholesale energy markets.

The REMIT Forum is a yearly event bringing together ACER and its stakeholders to discuss the implementation and potential evolution of REMIT, including topics like transaction reporting, data quality, and market surveillance.

On Tuesday 5th December 2023, from 9.00 to 16.30 CET.

Online.

In March 2023, the European Commission proposed to amend the REMIT Regulation. The proposal came as a response to the high energy prices experienced in 2021 – 2022 and aims to align the scope of REMIT with the evolving market dynamics.

2023 REMIT Forum will focus on the main changes this revision would bring, including: