ACER webinar: security of electricity supply in Europe

ACER webinar: electricity wholesale market integration

ACER to decide on amending the congestion income distribution methodology for European electricity markets

ACER to decide on amending the congestion income distribution methodology for European electricity markets

What is it about?

On 5th July 2023, ACER has received a proposal by transmission system operators (TSOs) to amend the congestion income distribution methodology for European electricity markets.

What is the congestion income distribution methodology about?

Congestion arises when there is limited capacity to transport electricity between different areas. The congestion income distribution methodology makes sure financial settlements are allocated when congestion occurs in the electricity transmission grid. It determines how the resulting revenues, generated from congestion, are distributed among the TSOs to ensure fairness and efficient operation of the electricity market.

Why change the rules?

The amendment proposal contains two main changes. In particular, it:

- Aims at providing solutions to address unintuitive flows (i.e. when electricity flows from an expensive zone to a cheaper one), in order to guarantee a non-discriminatory treatment of all TSOs (as required by the capacity allocation and congestion management (CACM) Regulation).

- Specifies how congestion incomes generated from the exchange of balancing capacity and the sharing of reserves should be distributed among TSOs.

What are the next steps?

ACER will reach a decision on the proposal by 5th January 2024.

To take an informed decision, ACER will engage in discussions with TSOs and national regulatory authorities (NRAs) as part of its decision-making process.

Access the public notice initiating the procedure.

Regulators confirm the need for crisis support measures to be targeted and tailored

Regulators confirm the need for crisis support measures to be targeted and tailored

What is it about?

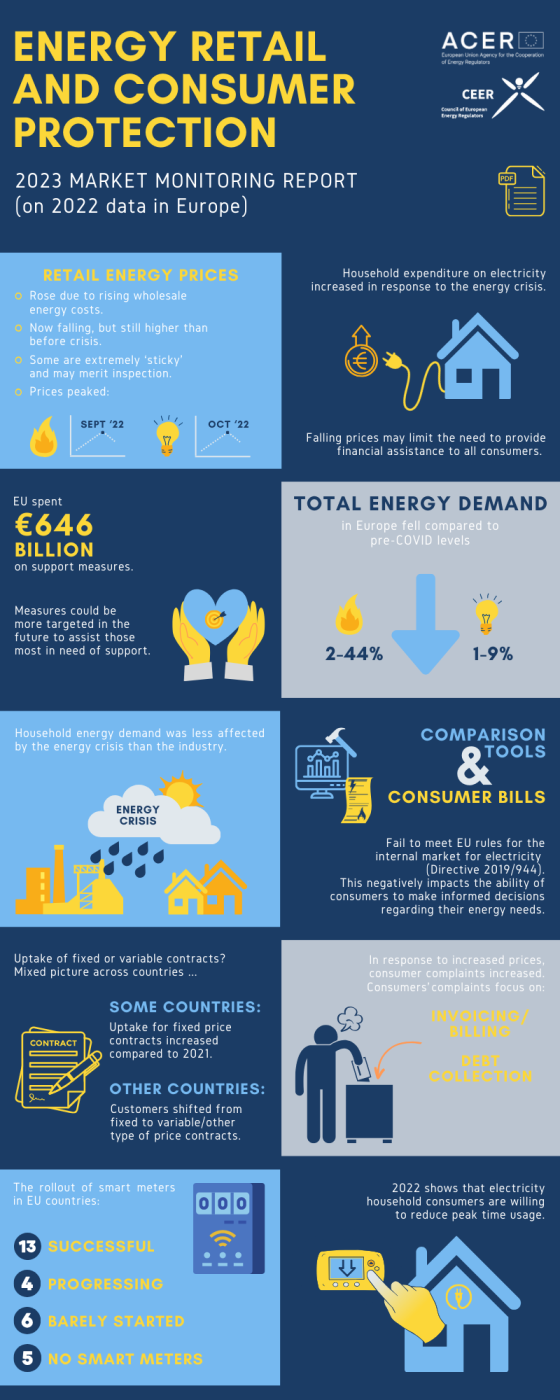

ACER and the Council of European Energy Regulators (CEER) publish today their Energy Retail and Consumer Protection 2023 Market Monitoring Report (MMR).

On annual basis, ACER and CEER monitor the European internal energy markets of electricity and natural gas. 2022 was an unprecedented year for EU energy consumers and retail markets, as the post-pandemic recovery and Russia’s invasion to Ukraine caused wholesale energy prices to spike, which then heavily impacted consumers’ bills.

Against this background, this year’s energy retail and consumer protection MMR (based on 2022 data) looks at:

- The number of measures implemented in EU Member States as a response to the energy crisis, the budget allocated for financial support to consumers and how this evolved during the year in different countries.

- The status of retail energy markets across Europe.

- The European energy consumption and energy retail price patterns over 2022.

- The level of consumer information provided via energy bills and the number of consumer complaints handled during 2022.

- The level of consumer protection and engagement (including how the role of consumer and the definition of energy poverty changed) across Europe.

What are the main findings?

- In most Member States, retail electricity and gas prices rose significantly in response to wholesale price spikes. Despite the recent (2023) wholesale electricity prices reductions, end-user prices are falling at slower rates.

During the crisis, governments in each Member State stepped in to support their residential and industrial consumers. Such support comes at a cost to national budgets. An important lesson from 2022 is the need to further target support measures (if needed) and to incentivise cutting energy consumption. - The crisis triggered demand reductions, particularly among industrial customers. On the contrary, energy demand in the household sector was not highly affected by the energy crisis.

- While in some Member States the uptake for fixed price contracts increased (compared to 2021), in others, customers switched to a variable price or other type of price contracts.

- The number of consumer complaints increased during the 2022 crisis.

- Thirteen Member States have successfully rolled out smart meters, while five countries have not yet started the roll-out. Hence not all consumers have the same opportunities to actively engage in energy markets.

- Consumer bills and comparison tools fail to meet the criteria as set out in EU laws. High-quality tools are needed for consumers’ informed choices.

- Practice shows that electricity household consumers are willing to reduce peak-time usage.

The report also provides a series of recommendations, including:

- A list of possible targeted support measures that Member States could opt for in the future.

- The need to enhance monitoring and simplify access to information, so consumers can be more engaged, even in rapidly evolving market situations.

- The requirement for comparison tools covering the entire market to meet the standards set by EU law. It is key that consumers are able to understand their bills and are in a position to take informed decisions about their energy consumptions.

Would you like to find out more?

Access the 2023 energy retail and consumer protection market monitoring report.

Check out the MMR publications and energy market data from previous years.

Access the report's infographic.

What’s next?

Join our ACER-CEER webinar: Monitoring energy retail markets and consumer protection on Thursday, 14 September 2023. You will learn more about the report’s findings and can interact with our experts!

ACER-CEER webinar: Monitoring energy retail markets and consumer protection

ACER-CEER webinar: Monitoring energy retail markets and consumer protection

ACER’s latest REMIT Quarterly announces the REMIT Forum 2023

ACER’s latest REMIT Quarterly announces the REMIT Forum 2023

What is it about?

REMIT (Regulation on Wholesale Energy Market Integrity and Transparency) provides an EU framework for the transparency and integrity of energy markets and deters market participants from manipulating the market. It therefore has an important role in protecting the interests of companies and consumers and ensuring trust in energy markets.

What is the REMIT Quarterly?

The REMIT Quarterly is ACER’s main channel of communication with stakeholders on REMIT-related matters, providing updates on ACER’s REMIT activities.

The 33rd edition comes in a new format with an increased content scope and covers the second quarter of 2023, featuring:

- Announcement of the 7th ACER REMIT Forum, taking place on 5 December 2023 (online);

- Analysis of and recommendations on non-intuitive commercial exchanges in Single Day-ahead Coupling (SDAC);

- Statistics for registered reporting mechanisms’ (RRMs’) contingency reports;

- Updated overview of the sanction decisions for the past four quarters, with 372 REMIT cases under review at the end of the second quarter of 2023;

- A brief overview of trading on organised market places in the second quarter of 2023; and

- Other latest REMIT updates.

Access the 33rd issue of REMIT Quarterly.

Access all issues of REMIT Quarterly.

ACER urges market participants to improve the quality of reported LNG data

ACER urges market participants to improve the quality of reported LNG data

What is it about?

Since 31 March 2023, ACER has been producing and publishing its daily Liquefied Natural Gas (LNG) price assessments and benchmarks, as required by Council Regulation (EU) 2022/2576. The Regulation also imposes data reporting obligations on LNG market participants.

ACER regularly reviews the reported data to ensure its consistency with the LNG data reporting requirements. Since the start of LNG data reporting, ACER has observed data quality issues related to:

- Completeness;

- Timeliness; and

- Accuracy of the reported data.

ACER’s Open Letter on LNG market data quality

In its Open Letter on LNG market data quality, ACER highlights the most frequently observed data quality issues and urges LNG market participants to improve the quality of the reported data by:

- Diligently addressing any data quality issues;

- Promptly informing ACER of such issues; and

- Proactively ensuring compliance with the reporting requirements outlined in the ACER’s LNG data reporting guidance.

Good quality of the reported LNG data will enable ACER to more effectively monitor the LNG market for its LNG price assessments and benchmarks.

ACER remains committed to fostering engagement opportunities and information exchange through webinars and other activities to assist interested parties in addressing LNG data quality issues.

ACER calls for gas system operators to tackle gas transmission bottlenecks

ACER calls for gas system operators to tackle gas transmission bottlenecks

What is the report about?

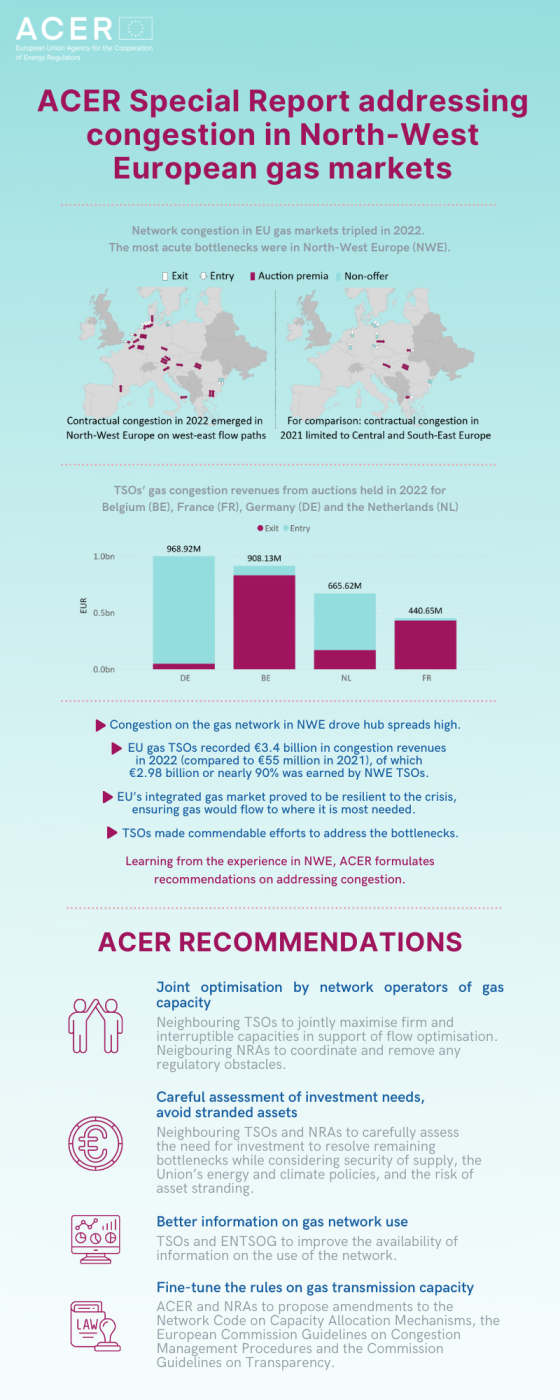

The European gas system was gas primarily designed for transportation of Russian supplies from east to west. Following the Russian invasion of Ukraine, Liquified Natural Gas (LNG) and increased pipeline supplies began to enter Europe from the west, which caused bottlenecks in North-West Europe (NWE).

Addressing congestion in North-West Europe

In addition to its annual monitoring of congestion, ACER publishes today its Special Report on addressing congestion in North-West European gas markets. The report examines:

- How acute bottlenecks emerged in Belgium, France, Germany and the Netherlands;

- How the respective Transmission System Operators (TSOs) and National Regulatory Authorities (NRAs) addressed the bottlenecks; and

- The lessons learnt.

What did ACER find?

- Congestion on the gas network in NWE drove hub spreads high.

- TSOs benefitted from significantly higher congestion revenues in 2022 (compared to 2021). EU TSOs recorded €3.4 billion in gas congestion revenues in 2022 (of which €2.98 billion or nearly 90% was earned by NWE TSOs); for comparison, EU’s total gas congestion revenues in 2021 were €55 million.

- The EU’s integrated gas market proved to be resilient to the crisis, facilitating the reconfiguration of supply and demand, and ensuring gas would flow to where it was most needed;

- TSOs made commendable efforts to address the acute physical bottlenecks from Belgium to the Netherlands, from Belgium to Germany and from France to Germany by increasing the gas capacity (kWh/h) available;

- But, while there was coordination among neighbouring TSOs, such coordination and information availability weakened while striving to maximise the availability of firm and interruptible capacities on both sides of the borders under difficult circumstances. This resulted in mismatched transmission capacities. In addition, the availability of information on the optimised network could be improved. Hence, a key learning is the need for continuous coordination and information sharing.

During an energy crisis, short-term mitigating actions are important:

- Europe’s voluntary gas-demand reduction target has been extended until 31 March 2024;

- The storage-filling targets agreed in 2023 were updated for 2023.

No-regret measures include:

- Addressing the most acute gas bottlenecks (in this instance, NWE) to improve market efficiency in the short term;

- Optimising existing infrastructure to accommodate new gas supply routes.

ACER recommends:

- Joint optimisation by network operators of gas capacity;

- Better information on gas network use;

- Careful assessment of investment needs to avoid stranded assets;

- Fine-tune the rules on gas transmission capacity.

Access the ACER Special Report on addressing congestion in North-West European gas markets.

Access reports' infographic.